Proforma invoice in New Zealand

What is a proforma invoice?

A proforma invoice is a preliminary bill which is used for requesting payment before goods are supplied to a customer or before services are performed. One beneficial detail about a proforma invoice is that it helps to ensure that both supplier and customer are on the same page in regards to terms such as goods to be supplied, the listing price, any discounts and other aspects dealing with the delivery of goods or services.

This document acts as a good faith agreement and helps both parties to plan for the future. Despite the fact that all information and figures on a proforma invoice are estimates only and are subject to change, it gives all parties involved, a good indication on how to prepare and plan for their budget. Proforma invoices grow more in importance as the value of the transaction increases as the forecasted numbers and details assist in planning finance as well as assisting with operational aspects.

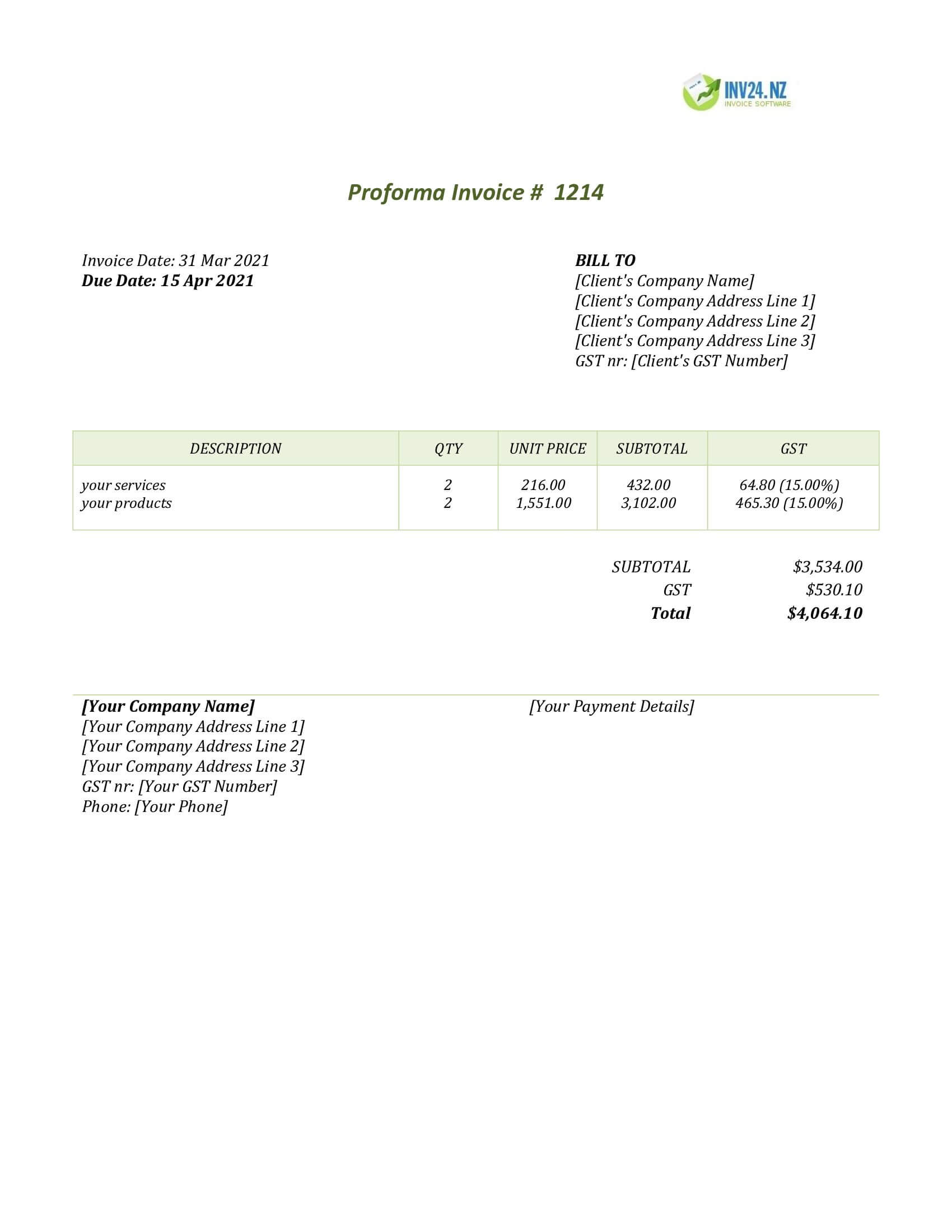

Proforma invoice sample

How to create a proforma invoice

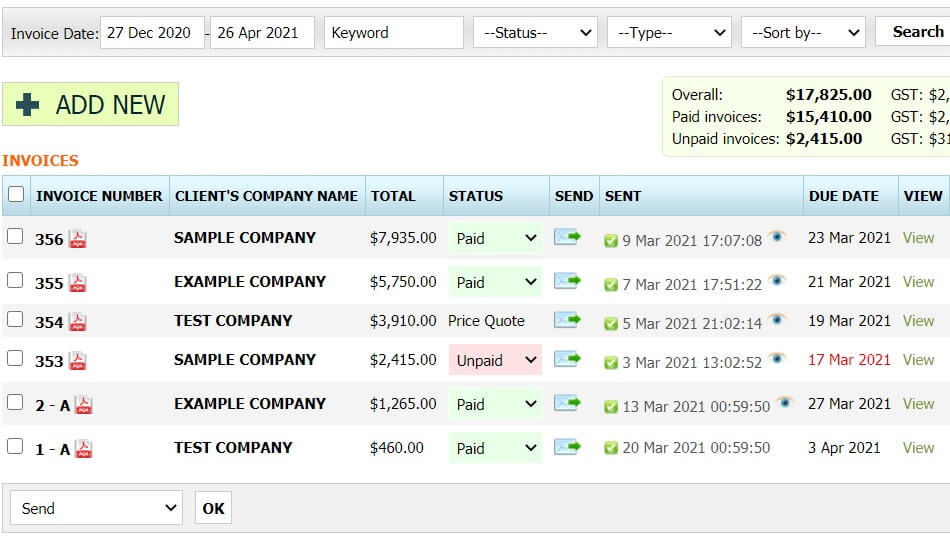

Method 1: Use our simple invoice software for New Zealand

- Try It Free

- When you add invoice, set invoice type to “Proforma invoice”

- You can convert a proforma invoice into a GST invoice and deliver it to your customer in just a few clicks.

-

Method 2: Download a free proforma invoice template for New Zealand:

Proforma Invoice: An in-depth Explanation

Difference Between a Proforma Invoice and an Invoice

The main difference between a proforma invoice and a standard invoice is that proforma invoices contain estimates of facts and figures. On the other hand, invoices contain real and determined facts and figures.

Another difference between the two forms is concerned with the time that the forms are sent to the customer. A proforma invoice is issued to the customer before goods are delivered or services are performed. On the other hand, an invoice is issued when goods have already been dispatched to the customer or the services have been performed. The purpose of a proforma invoice is to align the expectations of seller and customer. In contrast, an invoice is a legal document which can be used as evidence of the sales transaction.

Both proforma and standard invoice have been agreed on by seller and buyer. In addition, proforma invoices have the same content as a standard invoice, such as billing information, logo, contact information, and terms and conditions. However, it is vital to mention that each invoice must be labeled clearly as either a proforma invoice or invoice.

From an accounting perspective, proforma invoices cannot be used as supportive evidence for posting transactions. This means that the accounting system cannot be updated based on what is on the proforma invoice. The reason being, is that at the date the proforma invoice is issued, goods have not yet been delivered. Risk and rewards have not been transferred and so the accounting provisions do not allow for transaction recording. On the other hand, with an invoice, risk and rewards have been transferred as the goods have already been dispatched to the customer.

Price Quote vs Proforma Invoice

A price quote occurs at the initial stage of the transaction or dealing. The purpose of the price quote is to communicate to the other party the intentional price which they would agree to accept for the goods or service. At this point in time, as this is just a negotiation phase, there is no mutual agreement between the parties.

On the other hand, a proforma invoice is an estimated bill that is issued and based on agreed terms between seller and customer. There is an element of mutual agreement between the parties and the deal has been finalised. The seller can expect payment from the customer as the proforma invoice acts as a tool to ensure that both parties are on the same footing.

In the situation where a customer is to make an advance payment, the importance of a proforma invoice increases exponentially. The proforma invoice acts as a basis for calculating the advance payment.

In summary, the main difference between a price quote and a proforma invoice lies in the fact that with a price quote, payment is not expected as there is no deal. It is just a step in early negotiations. However, with a proforma invoice, payment is expected as the deal has been finalised between the seller and customer.

Following, detailed aspects of using a proforma invoice for advance payment will be discussed.

Proforma Invoice for Advance Payment

In normal operations, an invoice is issued by the seller when requesting payment. When dealing with advance payments, it is usual practice for some sellers to implement policy to deal with such payments. Normally, once payment has been received, the goods will then be dispatched to the customer. In the situation of advance payments, since the goods have not yet been dispatched, an estimated invoice in the form of a proforma invoice is issued to allow parties to get a sense of the payment size.

Since proforma invoices are subject to change, it may mean that the purchase price may need to be modified once a final invoice is received. If a customer has made a payment on the basis of a proforma invoice and the pricing is different to the final invoice, then it will be necessary to post adjusting accounting entries into the accounting system.

For instance, if an advance payment has been made by the customer on the basis of a proforma invoice and the resulting final invoice has a higher amount, this will mean that the customer will need to create a liability for the additional amount and make the extra payment. If the price of the final invoice is lower than the proforma invoice, then the customer can expect a refund from the seller.

It is important to note that proforma invoices can be used for both local and international trade. However there is a higher frequency of usage of the proforma invoice in international trade. Next we will explain how proforma invoices are used for exports.

Proforma Invoice for Exports

There are significant procedural formalities associated with the export process. They lie in the areas of port, banking, freights, duties, customs, inspections and many more. Due to this complexity, it may lead a foreign buyer to have some confusion about aspects such as transaction currency, description, products and others.

This is where the proforma invoice can simplify the process. Since, proforma invoices are issued with comprehensive descriptions, this enables the seller and buyer to have the same understanding. These descriptions include, seller and buyer name, buyer reference number, inquiry date, brief product description, product price, cubic volume, packing dimensions, shipping weight, delivery point, trade volume, payment terms, selling terms, port of dispatch and delivery and currency of transaction.

The proforma invoice used in the intricate export trade helps to clarify the expectations between seller and buyer so that all aspects of the transaction can be better planned and managed.

Sample Email Template for Proforma Invoice

Hello {Customer name},

Please find the attached proforma invoice # {XXX} for your reference and perusal. In the given attachment, we have outlined detailed aspects of the trade, such as product description, unit price, payment terms, and other information relevant to our trade.

However, if you have any further questions, please feel free to reach us at {Phone / Email}. Please note that we are committed to meeting your expectations and are obliged to deliver products in line with the terms mentioned in the attached invoice.

Thank you for doing business with us!

Kind regards,

{Your name}

{Your position in the company}

{Your company name}

{Your contact details}

Conclusion

A proforma invoice is issued before goods are delivered to the customer. It serves as a useful instrument to help clarify the terms between buyer and seller. As it contains estimated facts and figures, it gives both parties an indication on what to expect from the transaction. Another requirement is that it must be labelled clearly that it is a proforma invoice. In addition, since it is not a legal document, the accounting system should not be updated on the basis of the proforma invoice.

Proforma invoices are also issued for collecting advance payments. This is helpful as it can be used to estimate the size of the advance payment. Furthermore, the proforma invoice helps to define the terms when used in international trade.

The proforma invoice is distinct from a normal invoice as a normal invoice contains factual information and is used as supporting documentation to process accounting and related transactions. Unlike a proforma invoice, a standard invoice is issued after goods are dispatched to the customer or the services are performed.

Frequently Asked Questions

What are the essential features of a proforma invoice?

Following are some of the essential features of a proforma invoice:

- It is an excellent negotiating strategy for international trade

- It is a voluntary document, meaning that it may not be required for all transactions

- These invoices have validity for a specific period of time

What are the essential components of a proforma invoice

Following are some of the essential components of a proforma invoice:

- Product description including quality matrix

- Delivery terms and features

- Details of delivery

- Terms of sale

- Transaction currency

When is the proforma invoice sent to customers?

A proforma invoice is sent to the customer as soon as the product pricing is agreed upon by buyer and seller. In most situations, the proforma invoice is sent to ensure that both parties have the same intentions. It can also be sent when an advance payment has been requested for the transaction.

Other types of invoices for New Zealand:

- GST Invoice: standard invoice issued by a GST payer

- Invoice for GST non-payer: standard invoice issued by a GST non-payer company

- Credit note: refunding a customer

- Recurring invoice: automatic invoicing a subscribing customer

- Price quote: price offer of a fixed price for specific goods or services

- Debit note: requesting a refund from a vendor