Duplicate Invoice / Double Invoice in New Zealand

A double or duplicate invoice is when two invoices are generated for a single delivery or one-time performance of the services.

Reasons for Double or Duplicate Invoices

Following are some common reasons for double or duplicate invoices:

Technical problem

The generation of a duplicate invoice may be due to a technical error in the accounting or invoicing system. If this happens, it is important to see if the invoice was double accounted for.

Problem with communication

If there is a communication gap between departments that are generating and sending the invoices, it might lead to multiple generation and dispatch of a single invoice.

Administrative issues

The seller’s system may not be updated with the customer’s payment. Hence, they might send a double invoice.

How to Avoid Duplicate Invoices

It is important to address duplicate invoices otherwise, it may lead to the impairment of financial records due to the overstatement in revenue and payments. To do this, businesses need to ensure that they implement certain controls and procedures to avoid duplicate invoices. These controls are discussed below:

Implement invoicing controls

It is advisable to implement effective invoicing controls such as the segregation of duties, invoice approval, sales and invoice reconciliation, matching, vendor management, and implementing a policy of unique invoice numbers, as well as others.

Ensure adequate communication and coordination

Minimizing the risk of duplicate invoices can be achieved by adequate departmental communication as it helps facilitate timely information sharing, enables problem solving and encourages transparency.

Bring accountability culture

An overall culture of accountability and transparency can be achieved by allocating different responsibility for the different processes and coordination.

Conduct pre and post audits of sales records

In the pre-audit phase, audit procedures are applied to the invoice before it is sent to the customer. On the other hand, a post audit takes place and audit procedures are performed once the transaction has been executed or when the invoice has been sent. There are various invoice testing procedures that include but are not limited to the following:

- Review duplicate invoice prevention mechanism in the invoicing software.

- Review approval and authorizations of the invoice.

- Review compliance with the applicable company internal regulations and policies.

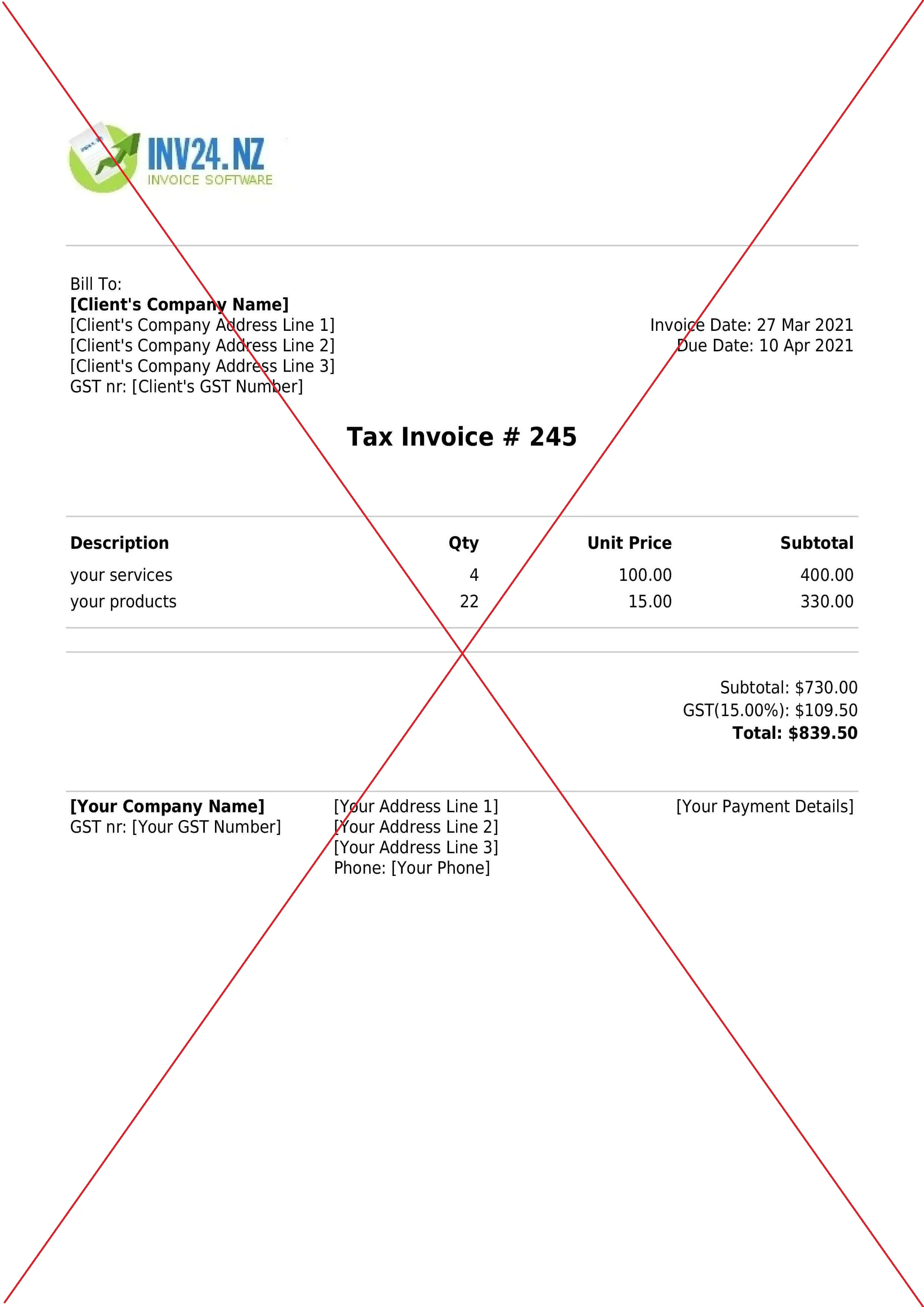

Look for better invoicing software

A good invoicing software will help to keep your data organized and prevent duplicate invoices. This means that there will inevitably be less chance of errors.

Invoicing tools for New Zealand: