How to Deal With Incorrect Invoices in New Zealand

A systematic approach to understanding and communicating the problem is vital when dealing with an incorrect invoice. There are two perspectives in regards to incorrect invoices as it impacts the seller as well as the customer. Following will be a discussion on how incorrect invoices are dealt with.

Invoice Error From a Customer’s Perspective

Review the invoice and identify the problem

There is a need to review the invoice and identify whether there are any errors or misstatements. This review can be done by the following:

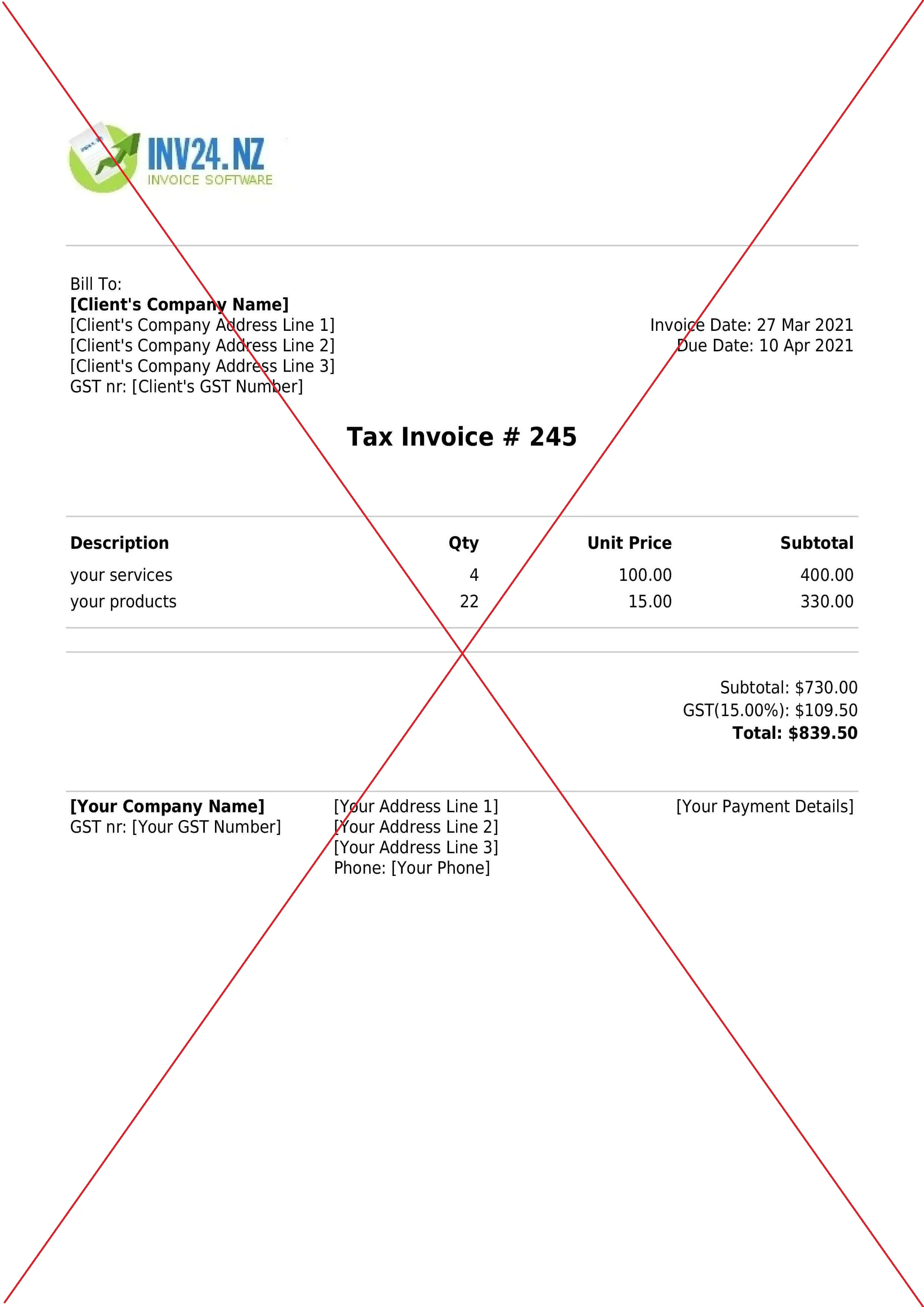

Verification of the basic invoice information

Basic invoice information such a supplier details, product price, quantity and other essential content and data must be reviewed.

Check invoice date and due date

To ensure compliance with the matching concept, accuracy of the invoice and due date is essential. It will also make a seamless payment experience.

Reconcile supporting documents

In order to ensure the accuracy of the invoice’s content, it should be compared with documents such as approved purchase orders, contracts and agreement, goods received notes and other relevant source documents.

Check mathematical accuracy

It is prudent to recalculate the numbers in the invoice to ensure that there is no mathematical error.

Verify discounts and taxes

This can be done by comparing the discount amount with the agreement or contract to ensure the accuracy of the application. Similarly, confirm that the tax code and applicable rates have been correctly used.

Document the nature of the error

If you happen to find an error or misstatement on the invoice, then this is the time to document the error. A handy tip is to draft detailed aspects of the error on a separate sheet of paper. So for example, if the supplier has sent you an invoice with an overstated amount, you can make a note on the paper, “Invoice # XXX received from XYZ is overstated by YYY amount.”

Communicate errors with the vendor

The next step is to make a formal correction request from the supplier. This can happen if the company policy permits this. It is also professional to include relevant supporting documents when sending an invoice for correction. So for example, if the supplier has not applied the appropriate tax code, then it is good practice to provide them with supporting documents and references to the law in order to receive an invoice correction. The main goal is to facilitate the supplier to make the correction.

Get corrected invoice

The aim is to request that the supplier send you a corrected version of the invoice. This will enable you to update the purchase system in line with the corrected source document. It is wise to keep documented and sorted records of all the correspondence, incorrect invoices, correction notes, correction requests, corrected invoices and so forth. This is so that things can be traced in the event of tax and financial audits.

Take care of accounting

Ensure to update the accounting record as per the corrected invoice or source document. Also, update the notes for the journal entries and adjustments as well as attaching supporting documents in the accounting system.

Review internal controls

It is wise to review the company’s internal controls to assess if there is any gap in the payment process. Maybe there is an opportunity to perform a walkthrough test for making payments and to assess if there are any weaknesses in the payment processing. A walkthrough test involves going through every step of the process or transaction to see and identify any control weakness in the processes. For example, you may notice that the payment processing system lacks a comparison amount between the invoices and the contract.

Invoice Error from a Seller’s Perspective

If the seller notices that there is an error on the invoice, the following steps elaborates on how to effectively deal with the situation:

Acknowledge the invoice error

If an error is noticed on the invoice, the first step is to acknowledge the error clearly, so that you can explain to the customer while developing an understanding. The understanding should be backed up by source documents, approved agreements, purchase orders, delivery notes and so on. This first step encourages you to acknowledge the error and take ownership of it by documenting the error with facts and figures.

Communicate observation with the customer

The next step is to communicate the error to the customer. This communication needs to be fast, efficient, timely and professional so that there will be no impairment in the business to customer relationship. This means that you need to ensure politeness and professionalism in the correction process.

Send corrected invoice to the customer

This is a simple step in the process where the corrected invoice is sent to the customer. It is good to select an invoice email template that is professional and clearly explains why you have sent the revised invoice to the customer. It is imperative to ensure that the customer understands the revisions and changes.

Make corrections in the accounting record

Depending on the nature of the error or misstatement identified on the invoice, there may be a need to correct the accounting record. For example, if the customer was charged an excess amount, a credit note will need to be issued and a correction based on this document will need to be posted.

Similarly, if the due date is wrong, it is a good idea to compare it with the credit terms as agreed upon in the approved purchase order and then proceed to change the due date accordingly.

Look where the process can be improved

To learn from the mistake, there is a need to identify the gaps in the implemented control that caused the error or mistake. For instance, take the situation where there is an error in the invoice quantity. In this case, you will need to see the quantity that was billed to the customer and compare it to the source document, which could be the purchase order and/or delivery note. There is a need to understand the gap and how this could be amended in order to avoid any future errors or misstatements. It is also professional for the seller to take ownership of the error by having an apologetic tone and promptly taking corrective action.

Sample email template for communicating observations with the customer

Subject: Notification for correction of invoice # {XXX}

Dear {Name of the Customer},

We intend to inform you that there has been an error in our recently issued invoice # {XXX}. We understand this error may cause significant inconvenience, and we are committed to resolving the matter.

Here are the details of the error:

{Clearly specify the nature of the error, like there may be incorrect pricing, quantity, product description or any other content of the invoice}.

After careful consideration and review of the supporting documents, we have taken the following steps to rectify the error:

Further, if you have paid the above invoice, we'll make sure to take appropriate action. Rest assured, we are open to listening to your point of view and are committed to resolving this matter on a priority basis.

Kindly accept apologies for the inconvenience.

Further, if you have any questions/queries, please reach us at {Your Email / Phone}.

Thank you!

{Your name}

{Your post in the company}

{Your company name}

List of Invoice Errors

Lets discuss the potential inaccuracies in the invoice and how these can be handled:

| Potential error/inaccuracy | Action needed |

| The customer’s name on the invoice is not correct | Issue a new invoice with the correct name of the customer. |

| Incorrect pricing in the invoice | Rectify the price and resend the invoice. It is a good idea to compare price charged in the invoice with the price agreed by the customer via source documents such as the contract, approved quotation, approved purchase order or any other source document. |

| Tax expense needs to be corrected | Review the tax working for accuracy. There is a need to review the applied tax name, tax rate, taxable price and overall tax liability. Also make sure to recalculate tax liability. |

| Incorrect invoice date | An inaccurate invoice date leads to a change in due date. So, if you find that the invoice date is incorrect, there is a need to rectify it. The rectification can be done by ensuring that the date on the invoice is the same as the date of goods delivered or the services performed. |

| Incorrect quantity | Compare the quantity on the goods delivery note with the quantity in the invoice. The quantity in the invoice should be the same as the quantity in the delivery note. |

| Duplicate invoice number | Issue a new invoice with the unique number. In addition, there is a need to mark this invoice as canceled due to a duplicate number. |

| Inaccurate sum or calculation | Recalculate the numbers and ensure that the correct sum or amount is written on the invoice. There is also a need to update the accounting record. |

| Currency error on the invoice | The currency used in the invoice may not be the same as agreed with the client. So, reviewing the contract or correspondence with the customer where billing or invoicing currency was agreed upon is a good idea. |

| Incomplete or inappropriate product description | Write a complete and detailed product description. It is useful in applying tax rates. |

| Billing for unapproved time | Make sure to revise the invoice in line with the approved time sheet. |

| Inaccurate hourly rate | Make sure to revise the hourly rate in line with the contract. |

| Incorrect billing address | Update the correct billing address. Obtaining an address from the customer's email is a good idea. |

| Duplicate line items | Remove additional/extra line items and revise the total amount due. |

| Incorrect job name on the invoice | Correctly update the job name on the invoice and resend the invoice. Also, mark the current invoice as canceled. |

| Incorrect payment terms | Correctly revise payment terms in line with the agreement or contract. |

| Incorrect deposit applied or adjusted | Review the deposit amount with the source document (bank statement) and update the invoice. |

| Incorrect shipping charges | Correctly update the shipping charges and resend the invoice. The shipping charges can be taken from the invoice received from the shipping company. |

Conclusion

To deal with incorrect invoices, as a customer, it requires an understanding and systematic execution of the process to obtain corrected invoices. This systematic correction includes identifying the problem or misstatement, reviewing and comparing with the source documents, communicating the problem with the supplier, receiving the corrected invoice, taking care of accounting and finally, implementing strong internal controls to proactively strengthen the payment processing system.

From the seller’s perspective, if the seller identifies an error in the invoice, they must take corrective action by informing the buyer, correcting the invoice and updating their controls so that any such problems and misstatements can be avoided in the future. To ensure the continuation of a good business relationship, the seller will need to take ownership of the error and remain humble and professional throughout the correction process.

Invoicing tools for New Zealand: