Intercompany Invoice in New Zealand

An intercompany invoice refers to a document that is used to request payment for sales transactions between two units or subsidiaries or divisions of the same parent company.

It is common practice in the business world that products or services are sold to each other within a group of companies. This can only happen if the seller and buyer are in the same group. There is a need to record the sales or purchase transactions in the individual books of the businesses. So an intercompany invoice is generated by the selling company and is sent to the buyer company. This means that the intercompany invoice is used to appropriately document sales and purchases and flow of payments between different units of the same parent company.

Intercompany Invoice Processing

The following details the key steps in processing intercompany invoices:

Generate invoice

This step involves the gathering of essential invoice content such as product description, goods quantity, price, tax and other relevant information required to generate the invoice.

Obtain approval

An intercompany invoice is not distinct from a normal invoice. A common theme is that a normal sales invoice may require approval from management. This is the same with an intercompany invoice and this means that approval from an appropriate managerial level is required to execute the intercompany transaction.

Keep an eye on transfer pricing regulations

It is vitally important to ensure the regulatory compliance with transfer pricing regulations. This compliance is important to ensure fair market value of transactions, prevention of tax avoidance, global consistency, risk mitigation (inconsistent pricing) and compliance with applicable regulations.

Perform intercompany reconciliation

It is essential to reconcile accounting ledgers of the different business units. This will help to ensure that any errors or discrepancies are identified timely with prompt resolution.

Ensure appropriate compliance and documentation

In the event of an audit, intercompany invoices must be backed by an intercompany agreement, internal communication and a complete audit trial to exercise the transaction.

Financial reporting with perspective to related party discourse

It is vital to keep a record of all transactions between related parties. Moreover, related party transactions are required to be disclosed in the notes of the financial statements in line with International accounting standards.

Intercompany Invoice Email Notification Template

Hello {Customer name},

This email intends to inform you that an intercompany invoice has been generated for your recent purchase with the following details:

- Invoice #: {XXX}

- Invoice date: {DATE}

- Due date: {DATE}

- Invoice amount: {AAAA}

Kindly review the attached invoice details in terms of completeness and accuracy.

Payment information:

{Payment information}

Please process the payment by the due date to avoid any disruption to suppliers. Further, if you have any questions, please reach us at {Your email / Phone}.

We thank you for the business cooperation and looking forward to serving again.

Best regards,

{Your name}

{Your title in the company}

{Your division / department}

{Your company name}

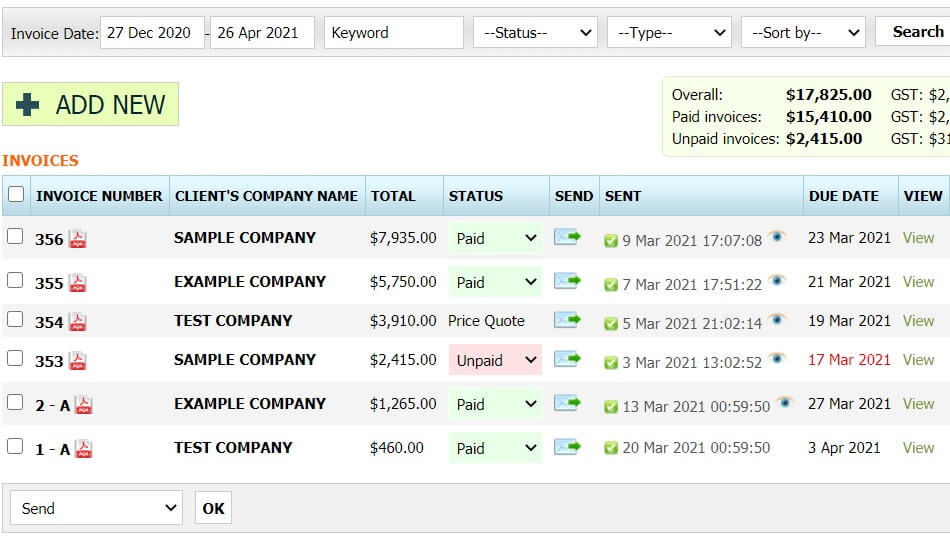

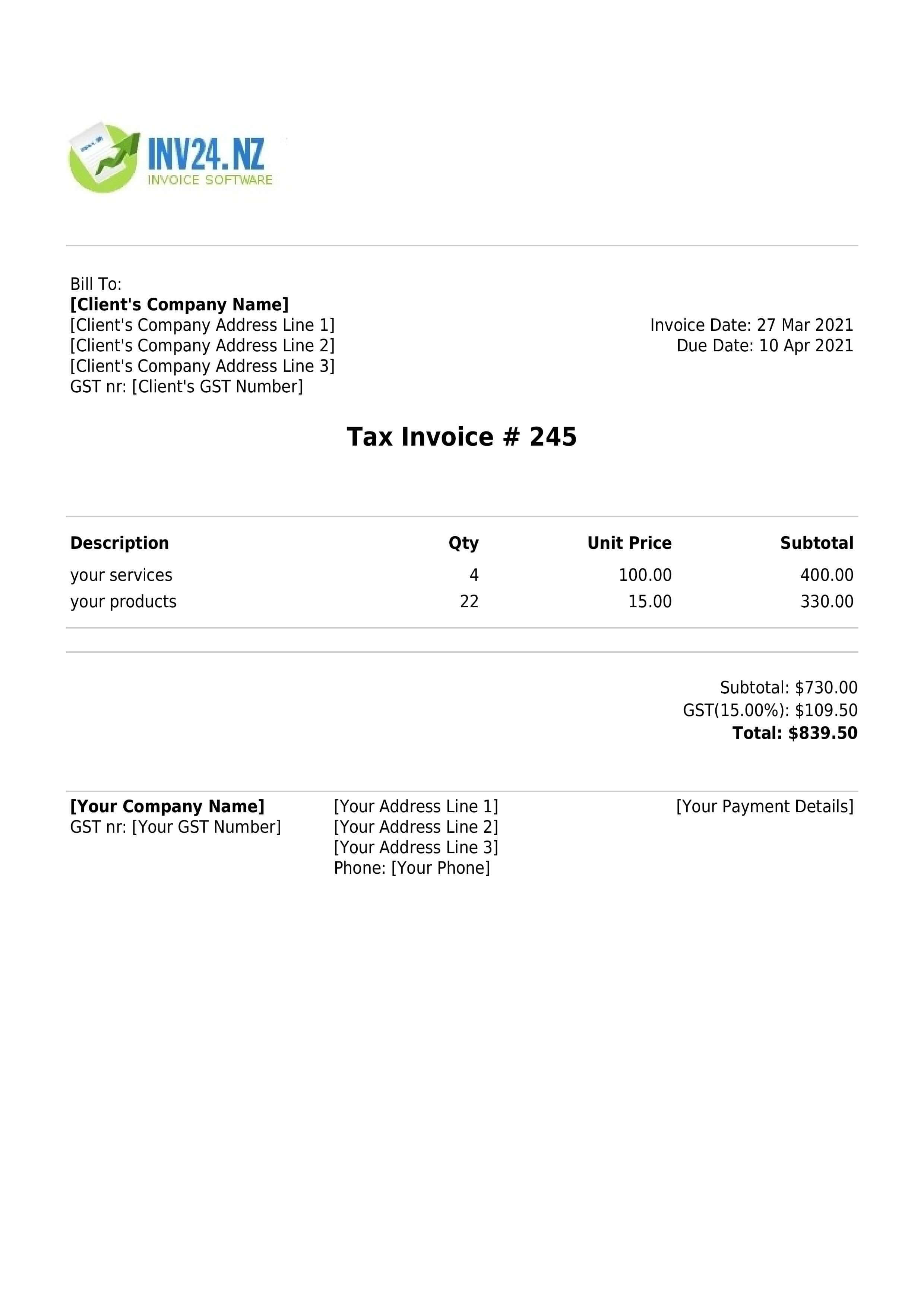

How to Create an Intercompany Invoice

Use our simple invoice software

Invoicing tools for New Zealand: