Invoice Due Date in New Zealand

The invoice due date is the specific day in which a customer is required to pay the amount owing on a certain invoice. It acts as the deadline for which the customer must settle their obligations or make payment. If they do not make the required payment by the invoice due date, there will be interest charges and a possible late fee applied on the overdue balance. This leads to income for the seller and a cost for the buyer.

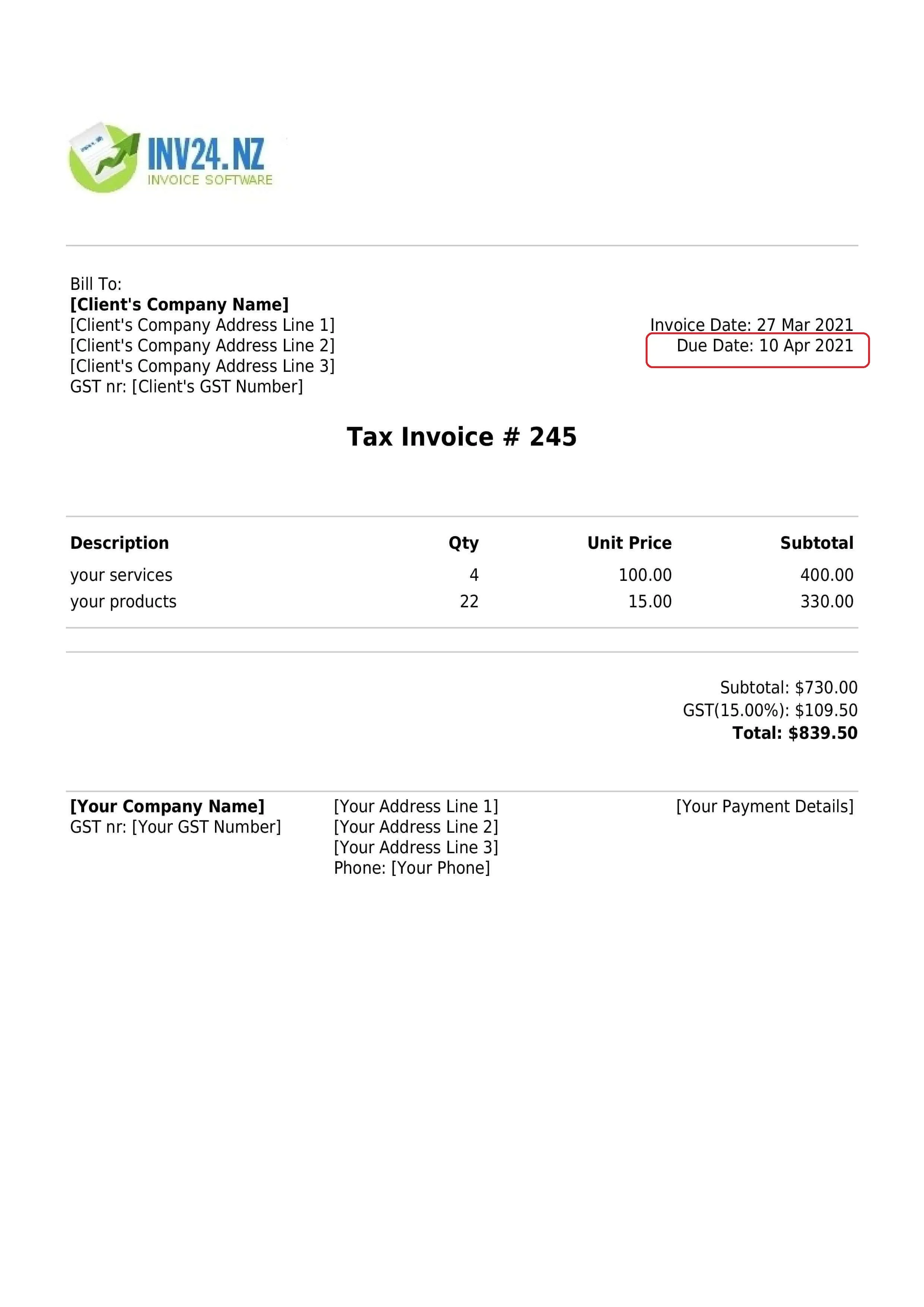

It is important to note that the invoice date and invoice due date are the same in the case of cash sales. The due date, however, falls ahead if sales are made on credit terms. Both of these dates are important for the accounting as well as operational aspects of the business.

Importance of Invoice Date and Due Date

The invoice date is essential as it helps to track the invoice due date. If for example, the invoice date is January 01 and the customer is approved for credit for 30 days, then the due date will be January 31.

The invoice due date is also used by the buyer to enable forecasting and budgeting to count the payment. Sellers also use this date to predict receipt. This essentially means that the seller uses the due date in their forecasting and budgeting to estimate the expected receipt date.

Invoice Payment Terms

Usually, terms on the invoice are read as, Net 07, Net 15 and Net 30. Next will be a discussion on what these terms actually mean:

Net 07

Net 07 is used to show that credit is approved for seven days. This means that the customer is required to make payment within the seven days of when the invoice is received. Net 7 is the most desirable credit term from the sellers perspective, after cash sales.

Net 15

Net 15 is when the customer is required to pay the invoice within the next 15 days of when the invoice is received. This term is considered as the most balanced credit term as it strikes a balance between the buyer’s expectation of credit and the seller’s need to receive the cash as soon as possible. In fact, most accounting software show net 15 as the default credit term when generating invoices.

Net 15 and net 07 are suitable to use in the case of new customers or for customers that have a trend of paying late. This is why net 15 and net 07 are more suitable for small sellers with limited cash resources.

Net 30

Net 30 is for when credit is approved for thirty days. So the invoice needs to be paid within 30 days of the invoice date. In practice, this actually is the term that is more frequently used than any other credit term.

As has been discussed, there must be some balance between the customer’s expectations to pay late and the seller’s business needs to receive funds as soon as possible.

The following table will outline why sellers and buyers have different interests in regards to credit terms:

Short Credit Period

| Advantages of short credit period | Disadvantages of the short credit period |

| For sellers, it is a great way to enhance financial stability. This is because payment with profit is constantly added to the system. | Sellers may have to offer a discount in order to receive early payment. |

| The cost of working capital financing is reduced for sellers. | The customer may switch to another supplier that offers longer credit terms. |

| It leads to enhanced flexibility for sellers. For instance, they can quickly adapt to changing market demand trends and meet market challenges as their money is not stuck in receivables for long periods of time. | The sales volume may be limited as customers might not be encouraged to buy from businesses offering shorter credit days. |

Long Credit Period

| Advantages of the longer credit period | Disadvantages of the longer credit period |

| For sellers, it is a great way to build goodwill for business and improve working relations with the customers. | There is a negative impact on the working capital management of the seller. |

| Sales are expected to increase with an increase in credit days. | The increased sales come with a higher risk of customer default & non-payments. |

| For buyers, longer credit days act as interest-free financing that helps to improve liquidity and create an element of ease in financial planning and budgeting. | The seller has to incur the cost of financing. It adversely impacts on their profitability. It is also a great bar on liquidity and working capital management of the seller. |

To have an effective credit policy, there is a strong need to understand your business, customers, market, competition, bargaining power of customers, suppliers, liquidity, gross profit, operating expenses, working capital, financing cost and much more. Take the case of businesses that operate in a highly competitive industry. In such a situation, it can be difficult to reduce credit days and vice versa.

Credit policy is an internal matter of the business and must be comply with applicable regulations. It should be designed with due care in order to strike a balance between business profitability and liquidity. It is also important to note that businesses can implement different credit policies for different customers, different products or services as well as different regions or countries.

Sometimes, a seller may demand cash payment via “invoice due on receipt”.

What Does "Invoice Due Upon Receipt" Mean?

“Invoice due on receipt” means that the invoice is to be paid as soon as it is received. The supplier may not have approved credit for this particular invoice, so it should be paid on the same day as it was received. In this situation, the invoice date and due date can be said to be the same.

Conclusion

The invoice due date is the date on which the customer needs to make payment of the invoice. It depicts the deadline that customers need to make payment by and a failure to do this may incur a late payment fee and or interest charges applied to the overdue balance.

This date is different to the invoice date, which is the date that the customer is billed for the goods delivered or services which are performed.

Both the invoice date and invoice due date carry significant importance. For example, the invoice date is important to record sales and purchases in the accounting system. Whereas the due date is important for planning for the budgeting and forecasting.

Terms such as Net-07, Net-15 and Net-30 are stated on the invoice and represents the day in which credit is approved. Each credit term has its advantages and disadvantages.

Generally, a small credit period is desirable for sellers and a lengthy credit period is desirable for buyers.

Frequently Asked Questions

Can we negotiate the invoice due date as a buyer?

Yes, it is possible to negotiate the invoice due date with the seller, however, they must be in agreement as to the proposed amendments.

What are the potential consequences of missing payment on the due date as a buyer

If the buyer misses the payment due date, this may impair the working relationship with the seller. It may mean that the seller will be reluctant to engage in business with the customer the next time. The seller is also entitled to charge late fees and/or interest fees and may even commence legal proceedings in court for the non-payment.

CREATE INVOICE ONLINE

Invoicing Tools for New Zealand: