Invoice Item Description in New Zealand

Invoice item description refers to the explanation of the products delivered or services performed for the customer and this is detailed on the invoice for which the customer is billed. As this is considered one of the essential components of the invoice, it serves as a record and helps to bring clarity and transparency. It helps to record the nature of items sold to the customer and because the item description is detailed clearly with all relevant information on the invoice, it will lead to customer satisfaction for the sales transaction.

Next will be a discussion on why the invoice item description is an important component of the invoice.

Why is the Invoice Item Description Considered an Important Component of the Invoice?

Documentation of the project specifications

The invoice item description is a documentation of the items for which the customer is invoiced. It serves as a legal record or evidence of the items that the customer was invoiced for. This makes it a record in the case of a dispute between the seller and buyer.

A way to communicate with customers

In the description, this is where the seller explains the specifications of the product or service provided in which the customer is invoiced. This makes the invoice item description a way to communicate the product or service specifications to the buyers.

Creates ease for reordering

The invoice item description helps to enhance ordering accuracy. By analyzing the item description on past invoices, the selling business managers are able to estimate the expected demand for specific products. This allows the managers to place orders based on data and trends. In addition, it is equally as important for buyers, as they use the item descriptions to reorder inventory.

Inventory management and revenue analysis

The invoice item descriptions helps to analyze and understand the breakdown of sales which are made by the business. The top-selling products and trending items are able to be ascertained. Also, it allows the assessment of the performance of different products that the business offers. This kind of in-depth understanding from this data allows the business to appropriately plan for inventory as well as enabling informed business decisions.

GST reporting

The invoice item description will help to identify if a product or service billed via the invoice is taxable or not, since not all products or services are taxable. So, the item description will enable taxable sales and non-taxable sales to be distinguished. Similarly, different products and services may be subject to different tax rates in different jurisdictions. In this way, the invoice item description helps to allocate the GST code and tax rate.

In short, the invoice item description is used in the context of invoice and billing with the primary purpose of providing a concise breakdown of the goods delivered or services performed.

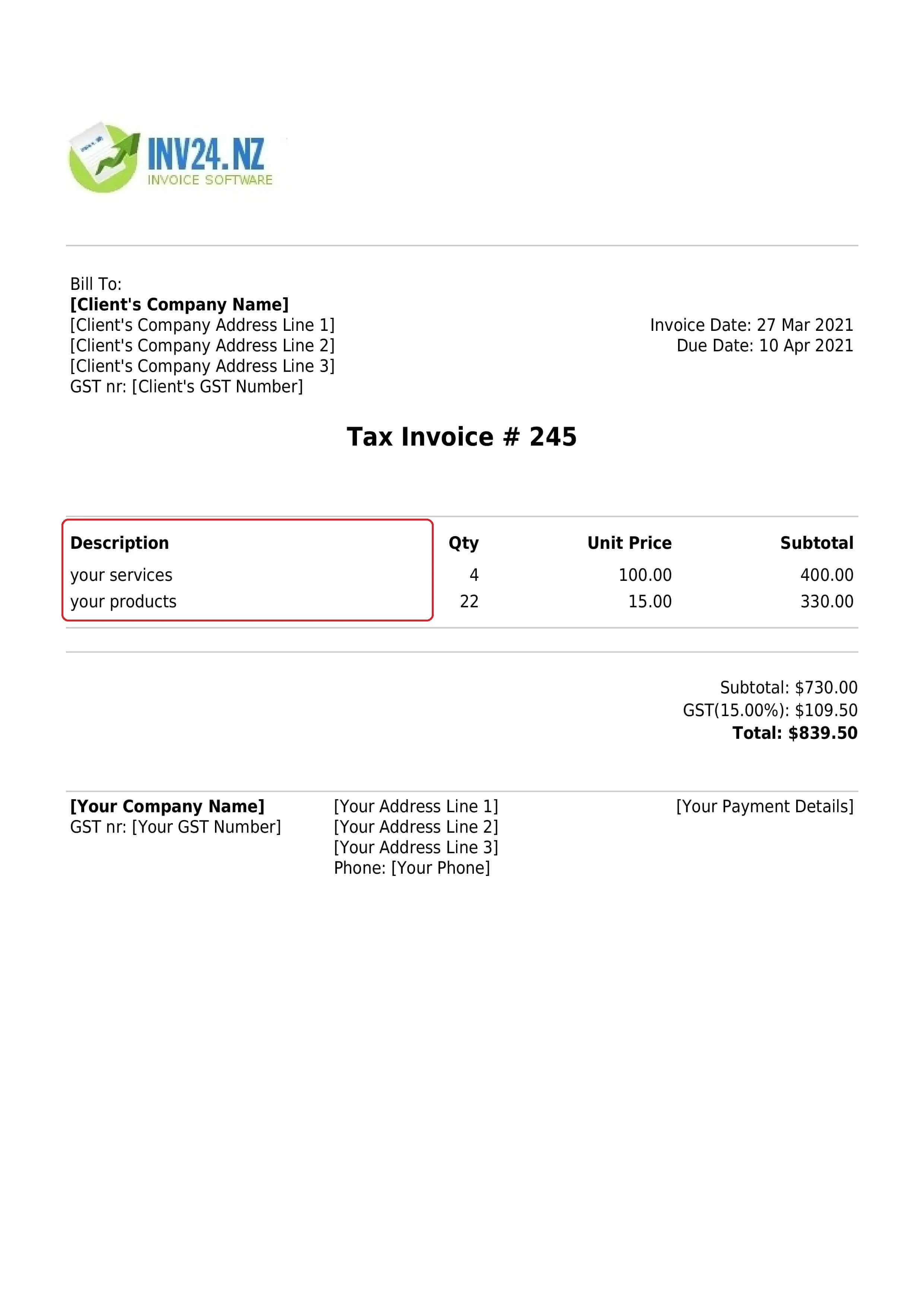

Sample of an Invoice Item Description

As an example for the business selling the product, the invoice item description can be: “Brand Electric Shower ModelABC440”

Similarly, the business selling services can have an item description of the following: “Hours of Senior Consultant”

Conclusion

The invoice item description is an essential component of the invoice. It serves as a way to communicate the nature of the goods or services to be billed to the customers. There is an added importance as it helps to manage inventory, reports for GST, reordering and is also used for record keeping purposes.

CREATE INVOICE ONLINE

Invoicing Tools for New Zealand: