Invoice Unit Price in New Zealand

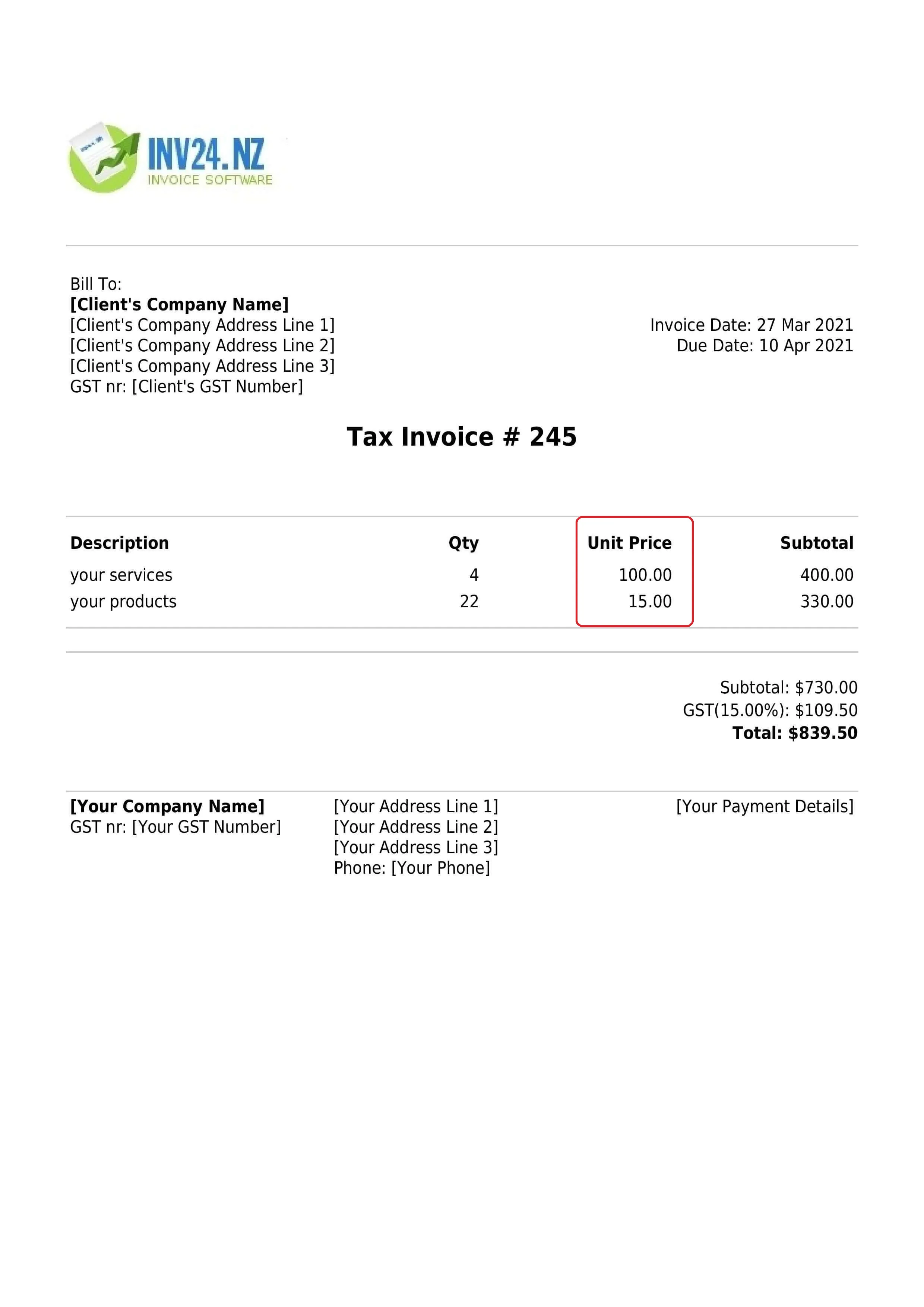

The invoice unit price refers to the cost of individual units sold to the customer. The unit price is multiplied by the total quantity of each product to reach the invoice subtotal value. So, for instance, if a business sells 20 units of product A at $5 per unit, the invoice subtotal value can be calculated as follows:

Invoice subtotal value = price per unit * quantity of item sold

Invoice subtotal value = $5 x 20 = $100

There can be different unit prices for different products and can even be different if the same product is sold in different quantities. For example, the per unit price can be a lower figure when a bulk purchase is made and vice versa.

For buyers, the invoice unit price is specifically important when the purchase is made in bulk. This is because it is a way to see how much cost will be incurred on a per-unit basis. This means that this information is considered extremely important for selecting an appropriate supplier. It therefore allows the business to make informed decisions while ensuring a profitable purchase.

Importance of Invoice Unit Price

The invoice unit price is highly important in the following aspects:

Accurate billing

The per unit price is crucial when calculating the total invoice value. By detailing and specifying the per unit price on the invoice, this will reduce the chance of errors or any potential disputes. This is due to the fact that the total for the invoice can be calculated based on the per unit price.

Enhanced transparency and understanding

When the buyer can see the per unit price on the invoice, it provides clarity as they will be able to have a clear understanding of the items that are being charged.

Serves as a legal record

Since an invoice is a legally binding document, all the invoice components, including the unit price, serves as a legal record.

A basis for price negotiation

Buyers tend to compare the unit price of the same product offered by separate and different suppliers. This allows them to shop around for the best deal. Even though the invoice is sent to the customer once the negotiation phase is done, the per unit price is still important for the negotiation of the next purchases.

Essential input of buyer’s pricing mechanics

Most businesses use cost plus margin as their pricing policy. This means that they need the per unit purchase price to add margin to obtain the sales price. The per unit price can be obtained from the invoice.

Buyer’s verification

The internal auditors use the price per unit to assess invoice accuracy before payment. This makes this an area which auditors regularly assess. Usually the per unit price on the invoice is compared with the unit price agreed in the contract or purchase order.

Assessment of product profitability

The per unit sales price is compared with the per unit cost to reach unit profitability. This means that the business needs to understand the per unit cost structure, which is obtained from the invoice, in order to reach product profitability. Product profitability is crucial for businesses operating at their full capacity as it helps to formulate an optimal sales plan that maximises profit.

Can the Unit Price be in Decimals on the Invoice?

The answer is yes, the unit price on an invoice can be in decimals. However, in electronic invoicing, it is recommended to use two digits after the decimal point in the unit price.

The reason for this requirement is that it intends to minimize the risk of differences due to rounding. Once the rounded price has been reached and multiplied with the quantity, the calculated total is not subject to further rounding.

In order to avoid any confusion about rounding, it is wise to sell the products in packs. For example, it can be a pack of 10, 20, 50, 100 and so on.

Example

If the product price is $2.764 per unit and you sell 100 pieces, you must round off the price to 2 decimals and then multiply. This would then be, $2.76 x 100 = $276. So, in this example, the business is able to charge $276 for 100 units.

On the other hand, you are able to sell a pack of 100 units at $276.40

The key is to negotiate the pack because if the deal is based on per unit price, there is a need to keep two decimals after the unit price before multiplying with the quantity.

Conclusion

The invoice per unit price is the price of individual units charged to the customer. This price is multiplied by the quantity to reach the invoice total.

The invoice unit price is considered as one of the important elements of an invoice as it helps with accurate billing, enhances billing transparency, serves as a legal record and is also essential for the buyers’s pricing policy and verification of the invoice.

The invoice unit price can be in decimals. However, there can only be 2 digits after the decimal in price. Further, in order to avoid rounding problems, it is a good idea to sell products in packs.

Invoicing tools for New Zealand: