Void Invoice in New Zealand

A void invoice is a corrective measure that keeps an invoice as part of the accounting or financial record, however, its impact is actually null or zero on the accounting records and financial reporting.

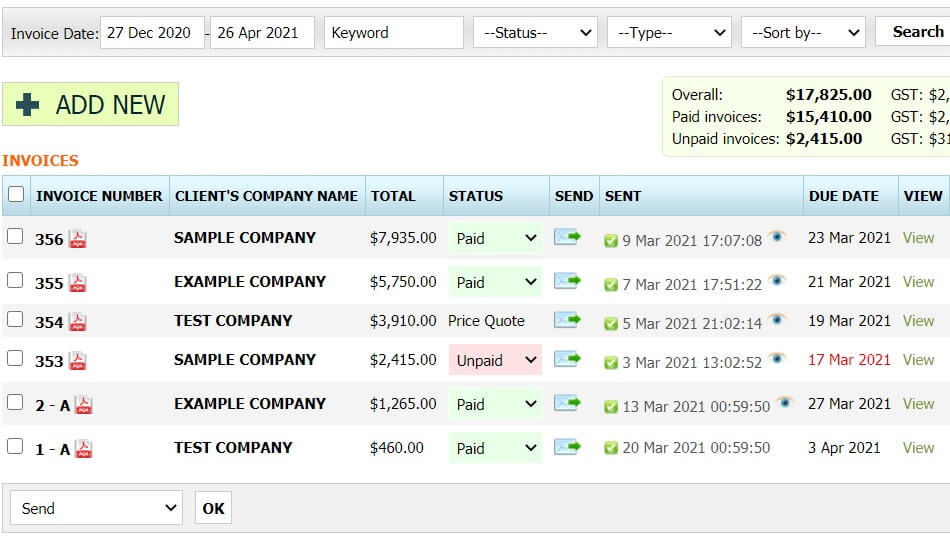

It is important to note that voiding an invoice is different from deleting the invoice. Deleting an invoice does not keep any trace of the invoice in the accounting system. On the other hand, voiding an invoice still keeps traces of the record, such as invoice number sequence. However, a void invoice makes an impact of null or zero on the accounting record.

Usually, a business may need to void an invoice due to an error, misstatement, inaccuracy, invalidity or some other undefined reason.

The concept of void invoices is more prevalent when using accounting software that comes with the capability to receive payment in a connected bank account. When the invoice is made void, the customer will be unable to make payment. Instead, in order to get paid from that particular customer, the business will need to reissue the invoice.

Next will be a discussion on the use of a void invoice.

Why are Void Invoices Used

In the following situations, use of a void invoice is ideal:

Transaction Cancellation

There may be a need to cancel an invoice, for example in the situation where the customer is no longer interested in the products or services that the seller is offering. Here, the seller may opt to void the invoice to ensure that the accounting record is complete.

Invoice Duplication

In the situation where an invoice is generated and is sent to the customer more than once, voiding the invoice would be a good option. This is to ensure clarity and transparency of the accounting record and financial recording.

Corrective Measure

There may be circumstances where you will be required to post certain corrections in the invoice. For example, the selected item, item price, item quantity or other details on the invoice may need to be corrected. A new invoice will need to be generated and the old invoice will be declared void and therefore, canceled. In this situation, deleting the invoice would also be adequate, however, it does not preserve the invoice sequence for record purposes.

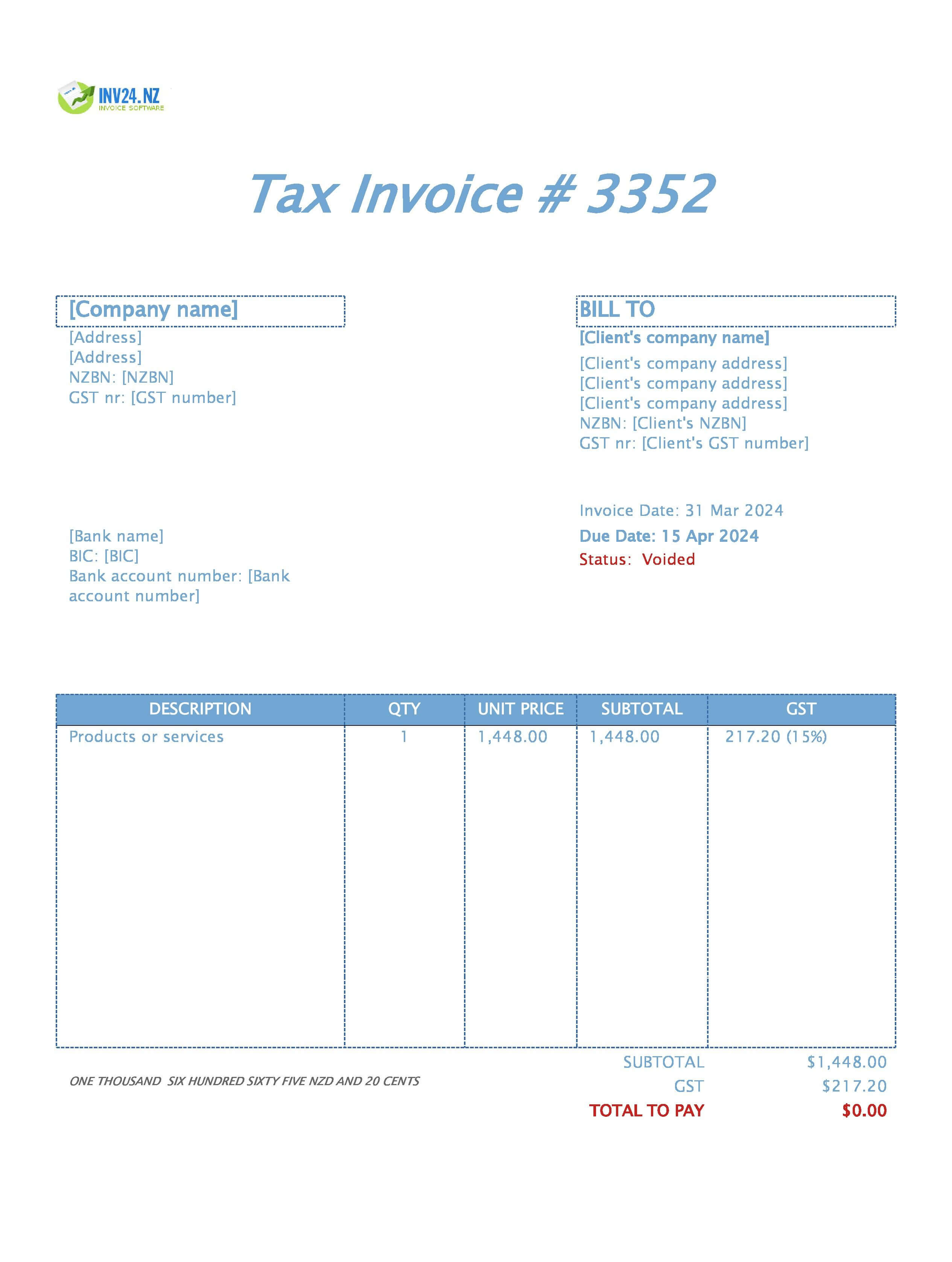

How to Void an Invoice

Use our simple invoice software

- Change the invoice status to "voided"

-

- Try It Free

Conclusion

Voiding an invoice means that its impact is made null or zero, without having to delete it. The basic details of the invoice, such as invoice number, date, and overall structure, remain part of the accounting system, however, its impact on the accounting record and financial reporting is null or zero.

The business can opt to void the invoice in the case of transaction cancellation, invoice duplication or as part of some corrective measure to fix the invoice.

Invoicing tools for New Zealand: