Accounting Software for New Zealand (All You Need to Know)

- What is Accounting Software for New Zealand?

- What Does Accounting Software Do?

- Who Uses Accounting Software?

- Types of Accounting Software

- Single Entry vs Double Entry Accounting Software

- Advantages of Accounting Software

- How Does Accounting Software Help in a Business?

- How Does Accounting Software Improve Productivity?

- Factors to Consider When Choosing Accounting Software

- Do Small Businesses Need Accounting Software?

- What Accounting Software do Large Corporations Use?

- Conclusion

- Frequently Asked Questions

What is Accounting Software for New Zealand?

Accounting software for New Zealand is a business software that is designed to keep financial data secure while also enhancing the overall efficiency of accounting functions and processes in New Zealand. It is primarily used by accountants, bookkeepers and business managers to record financial transactions as well as reporting on business performance.

Although operational procedures, analytics and reporting features for the accounting software differ from brand to brand, it can be tailored to the type of business of the company. Generally though, the operational screen is usually divided into functional modules such as sales, receivables, receipts, purchases, payables, payments, cash and bank (investment) and reporting modules.

It is important to note that the sophistication of the accounting software will differ depending on whether the business is a large or small business. For a large business, a more sophisticated and integrated accounting software will be beneficial, whereas accounting software for small businesses with limited features will be sufficient to help keep track of the financial process.

Let’s now discuss how software can help small and large businesses in the execution of accounting procedures and formalities.

What Does Accounting Software do?

Accounting software generally comes with the following functionalities or modules:

Customer Management and Invoice Creation

This sales module part of the accounting software enables the business to keep records of their customers. Such details that are recorded include name, address, contact information and email.

This is highly efficient as when a customer makes a purchase and the business sends the invoice to the customer, then all that is required is to select the customer, then input data related to the product quantity and rate. All the information about the customer such as name and address can be immediately fetched from the software, saving a lot of time.

In larger businesses that use the more sophisticated software, details such as quantity dispatched and rate to be charged can automatically be retrieved from the delivery management system and sales order (agreed rate) respectively.

Similarly, when an operational procedure is performed, the background accounting is automatically updated. For instance, if you create and send an invoice via the software, the software automatically records the sales and receivables. This means that when operational procedures are performed, the software takes care of the accounting recording.

In the same way, the software has the ability to send recurring invoices, quotations, credit notes and debit notes. These features however, may not be available in the more basic software subscription that smaller companies use.

Receivable Management

Receivable management helps to track all the payments that are due to the business from customers. The accounting software enables receivable management by producing receivable ageing, sending payment reminders to customers and will also allow the users to see if there is a need to make provisions or write off the balance.

Receivable ageing is a valuable tool to utilize as it can analyze whether there has been an excessive delay in collection of payments. It will enable the business to see if a customer has not been making payment for a long period of time. Moreover, it helps in the receivable management by producing analytics which will help to see whether subsequent course of actions are required to try to recoup the payments due.

Vendor and Expense Management

Accounting software can also record details on the database related to vendor details, such as name, address and email. Usually, when dealing with a transaction with a vendor, a purchase order is created and sent to the vendor requesting the purchase of the goods. When a purchase order is created, the only details that are entered into the system include specifications in relation to the order like price and quantity. The rest of the details such as email address are automatically retrieved by the accounting software.

It is important to note that the software does not create a liability or payable once the purchase order is sent to the vendor. Instead, when the delivery is received and the purchase order is marked as complete, then the system will automatically record a payable with the same amount as the purchase order which indicates that the business is owing the amount to the vendor.

Payable Management

This module in the accounting software focuses on payables which are liabilities which the company has, to make payment to other companies. It can help by providing a payable summary, payable ageing as well as internal reminders for the payables department to make payment. This module is extremely useful in industries where billing needs to be managed on a day to day basis. One such industry, includes the construction industry where the developers capitalize on all the expenses in building works and they need to manage payments to their vendors. An efficient payables management system can help the overall process in managing vendor payments.

Assets Management

This module of assets management provides comprehensive details about assets. These could include cost of the asset, location, book value, accumulated depreciation and other details related to assets. These details are highly useful in safeguarding assets from a security and valuation perspective.

Treasury Management

The more advanced accounting software comes with the ability to manage investments, cash, treasury bills and other banking features such as bank reconciliation. For the investment modules, the only step required is to update the market value for the investment on a closing day. The rest of the calculation for profit and loss is performed automatically and posted in the main ledger.

Similarly bank reconciliations can also be automatically generated. There is however, a necessity to manually clear individual transactions by inspecting the bank statement. This aspect of the accounting software helps to reconcile the bank balance with the bank statement.

Performance Analytics and Trend Analysis

In just a few clicks, the accounting software will enable users to visualize the movement of the account balance. It helps to understand the situations that create an impact on the financial numbers. For example, monthly trend analysis can help to see what sales are at its highest within a given month and other useful financial information. This can help the business to pre-arrange for later subsequent years.

Record Keeping

Advanced accounting software comes with the ability to store supporting evidence. This supporting evidence can be attached at the back of each transaction. For instance, when recording expenses in the software, an invoice can be attached. This feature enables the ability for the invoice to be automatically retrieved in a few clicks.

Real-time Financial Reporting

One of the most useful attributes of accounting software is that real-time financial reporting can be generated. Thus, the impact of adjustments and transactions can be seen in the blink of an eye.

If however, you opt for a manual accounting process, this same type of analysis could be a time-consuming task.

Automation

In terms of automation, accounting software can help in two ways. First, is operational automation. Taking the example of setting an invoice as recurring. You would not need to enter data and send the invoice each time a sale is made. Instead, since the invoice is set as a recurring invoice in the software, this would be automatically generated.

The second way that software helps in automation is when calculations are performed that follows a fixed pattern. For instance, there is no need to manually calculate the depreciation at each reporting period. Instead, there is a module of fixed assets that deals with these calculations. The overall implementation of automation leads to higher operational efficiency and reduced chance for any errors.

In conclusion, accounting software has the ability to assist in each and every aspect of business management. Since accounting software can be tailored to each business, it should be noted that specialized software has been developed for different industries.

Let’s now discuss who should use accounting software and the different types of accounting software that are available.

Who Uses Accounting Software?

Accounting software are utilized by business managers, consultants, business owners, tax agencies, accountants and finance officers throughout the world. A great feature of this software is that data is stored securely on the cloud database and pertinent information can be retrieved through the internet easily and instantly.

This software proves to be a useful resource that enables the collection, storage, management, analysis and reporting of financial information. The main purpose of accounting software is to create an overall ease and efficient process of recording, storage and reporting of financial information and data.

However, not all accounting software is compatible with all types of businesses. Before a company considers attaining accounting software, consideration must be made about the functions and features of the software. Following, will be a discussion on the types of accounting software.

Types of Accounting Software

Some of the well-known types of accounting software are as follows:

Invoicing Software

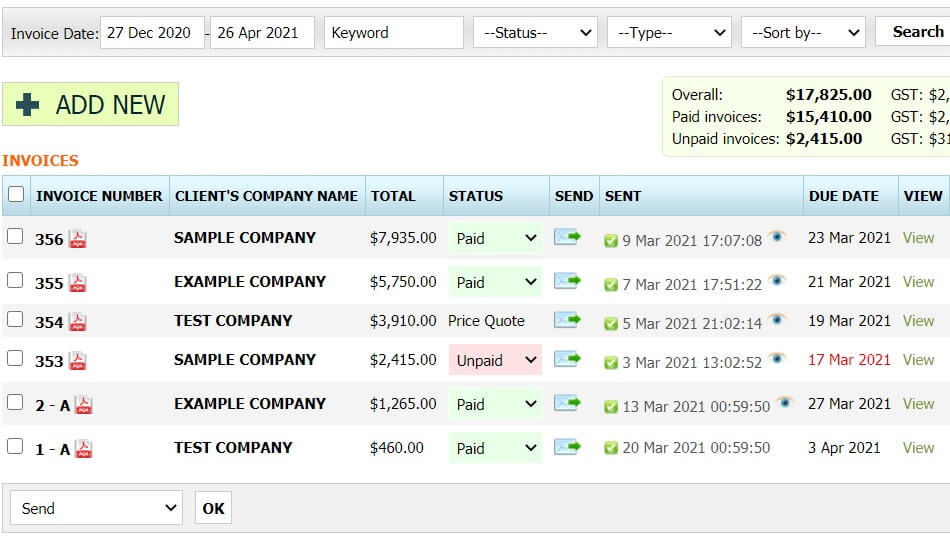

Click the image to see live demo version of simple small business accounting software for New Zealand without registration.

Invoicing software is designed to help in all operational aspects of business and assists with the management of the accounting in the background. If an invoice is sent to a customer, the software creates ease as all data related to that specific customer can be retrieved and the invoice can be sent to the email address which is stored in the software. In addition, it automatically records revenue in the ledger and also updates the receivables from the customer to whom the invoice was sent. This means that there will be no chance of errors. An invoice sent to Mr A cannot be recorded in the books of Mr B, which may happen in the case of manual accounting.

The valuable features and functions of the software are also extremely useful for businesses. The software can send quotations, manage recurring invoices, debit notes, credit notes, generate statement of accounts and customer statements, make bank reconciliation, manage inventory, revenue and expenses trends and analytics and much more. It can be seen as a complete package that helps in business execution from an operational and accounting perspective.

Enterprise Resource Planning – ERP

ERP is a complete package to help manage the business. Enterprise resource planning systems are more than just the accounting software that we have discussed. The functions and features are not only limited to operational accounting aspects and it goes beyond more than just a simple accounting software. The functions and features of an ERP include, distribution models, order management, procurement, e-commerce, accounting and finance, warehouse management, customer relations management, finance management, business intelligence supply chain management and even more.

The best part about the ERP is that all features are interlinked with each other allowing the bigger picture to be seen. The output of one module is the input into the next. Accounting information is extracted from each module or step in real-time so that the accounting books remain updated at all times. Also, specialized modules can be added when required.

Payroll Management System

A payroll management system is designed to incorporate the complete payroll system. Some features include the calculation of salaries in line with working days /hours, deductions, calculating applicable taxes, producing pay slips, depositing funds directly into the employee’s bank accounts and recording payroll expenses in the accounting books. This system automates all these processes which leads to higher efficiency and accuracy.

Single Entry vs Double Entry Accounting Software

Single Entry Accounting Software

Single entry accounting software refers to financial management tools which are designed to avoid complex accounting concepts, while easily recording financial transactions.

When using this system, the user does not need to be concerned about debits and credits while posting transactions. This is because each transaction is entered once, in terms of income and expense. In other words, the accounting journal only records cash received as well as paid. So, the user does not need to worry about accounting terms such assets, liabilities, or equity.

In short, business managers need not be concerned with technical concepts of debits and credits when entering transactions, using this type of software. All that is required when using this software is to record cash movement.

The absence of debit and credit makes accounting easy for business owners, especially those with limited or no existing accounting understanding. This makes this type of software the best choice for small businesses and freelancers, especially if they are looking to avoid complex accounting entries, challenging financial reporting standards, or extended procedural compliance.

The downside with this single entry accounting software is that limited financial insights, business metrics, and customization can be expected.

Double Entry Accounting Software

In contrast, double entry accounting software is seen as a highly credible and professional method of accounting and bookkeeping. This software helps to ensure that each transaction is recorded twice, in terms of debit and credit. This leads to comprehensive accounting records as well as reliable financial reporting.

In the past, users required comprehensive accounting understanding in order to post business transactions in the double entry accounting system. However, recent accounting software have pushed the role of the accounting as a backend function, with the operational screen as the prime source of data entry.

For instance, the preparation of sales invoices (which is an operational function) in the accounting software, automatically records revenue and receivables. In other words, the user is not required to post a debit and a credit. All that is required is to ensure an accurate invoice is generated. The system takes care of the backend accounting records which include, revenue, vendor ledger, trial balance, income statement, balance sheet and so forth.

However, in the use of double-entry accounting software, manual adjustments, estimates and judgments can be quite challenging.

Comparing Single Entry and Double Entry Accounting Software

The next table shows the comparison between single and double entry accounting software:

| Single-entry accounting software | Double-entry accounting software |

| Higher user-friendliness with limited or no accounting knowledge required. | It is a little bit more complex when entering transactions. There is a need to consider debit and credit of each accounting transaction to be posted. |

| Based on cash flow movement. In other words, cash-in and cash-out. | Based on systematic mechanics where assets = liability + equity. |

| Listing income and expense (limited capacity for financial analysis). | Able to produce advanced financial reports such as balance sheets, income statements, cash flow statements, statements of changes in equity, and statements of comprehensive income, as well as others. |

| Limited customization as there are no advanced features built-in. | Advanced customization can be expected regarding financial reports, vendor details, revenue and expense listing and so forth. |

| Higher risk of error due to no checks or limited checks. | Double-entry accounting software is expected to be more accurate. The accuracy is driven by the equality of debit and credit. In other words, the built-in debit and credit equality features help spot and therefore correct any misstatement or error. |

| It is challenging to accommodate an increasing number of accounting transactions. | Able to accommodate complex and increasing number of accounting transactions. |

| Limited analytical indicators in terms of cash movement. | It includes advanced features such as budgeting, forecasting, bank reconciliation, inventory management, integrations, and advanced trend analysis as well as others. |

Advantages of Accounting Software

There are numerous advantages of implementing accounting software which will now be discussed.

Accounting Simplification

Accounting books and accounting entries are automatically posted to the books when operational functions are performed. For example, in the case of sending an invoice to customers, automatically the revenue is credited and receivables are debited. Likewise, depreciation is automatically calculated and posted. This will provide assistance to the business manager who may have only a limited knowledge of accounting.

Cost Savings

Since accounting software aids in automation, administrative procedures to manage business activities are heavily reduced. This allows the employees looking after these functions, the ability to reduce time spent on procedural and repetitive tasks. Hence, the cost of payroll is saved.

Compliance

The internal structure of the accounting software is designed to abide by tax compliance. The reports and details provided by the accounting software are structured and comprehensive which means that the retrieval of the details for calculating tax liability can be done on a timely basis. In addition, some compliance tasks are automatically completed by the software.

Effective Customer Management

Timely communication with customers reflect well on the business and customer management is enhanced. This is due to the fact that the accounting software ensures that dates for billing, reminders, recurring billing, quotations and other communications are never missed. This can be done as long as the correct dates are initially entered into the system.

Data Protection and Data Security

If a reliable accounting software is chosen such as a cloud based system, then all data will be stored in a remote data server and maintenance and back-ups are taken care of by IT professionals. The data will remain sound and secure while enabling easy access from anywhere in the world.

Simplified Payroll

Payroll calculations can be complex and time consuming. At the same time, any error in the payroll may lead to demotivation from the employees perspective. To counteract these issues, if you choose to use a payroll management system, data, calculations and other procedures are automated, leading to higher accuracy and a more efficient working speed.

Easy Tax Filing

Accounting information that is offered by the implementation of accounting software enables tax filing to be performed easily. Further, some accounting software can have a taxation module. This significantly helps the overall process of tax management including tax planning and tax compliance.

Higher Accuracy of Financial Statement

Since financial statements are generated by the accounting software based on data entered, there are few chances of errors or misstatements in the financial statement.

Real-time Financial Reporting

Since an accounting software enables the generation of real time financial statements, in a few clicks, this aids in the analysis of business performance. This is because all essential reports such as balance sheet, income statement, statement of changes in equity and cash flow can be retrieved instantly.

The main take away from this is that accounting software helps a great deal in the execution of business. Let’s now turn to describing it in more detail.

How Does Accounting Software Help in a Business?

The following attributes of the accounting software helps in efficient business execution:

Automation

The main benefit of accepting software lies in the fact that it enables automation. The software has functions and features that automate processes. Since it avoids tasks that are repetitive and that consumes time and energy, business managers will benefit. For example, an employee may forget to send a payment reminder after 45 of the invoice. When using accounting software, this can be avoided as the software is designed to always be on time.

Integrated Modules

Since the output of one module is used as input to a second module of a process, the flow of information is highly accurate which leads to efficient business management.

Logical Insights and Visualisation

Accounting software is capable of showing trends or movement for any movement balance. Trend analysis and visual analysis allows informed decision making. For example, there may be an increasing trend in marketing expenses yet there is a decline in sales. In this scenario, management will be able to question the effectiveness of marketing strategies by just looking at the trend analysis.

Client Management

Business relations with customers will be enhanced, and will also reflect a professional business organization. This is because accounting software ensures that invoices, reminders and other important communication in regards to accounting and finance, are never missed.

Online Payments

Payment gateways can be linked with the accounting software meaning that customers can easily make payment in a few clicks. The customer can opt to pay via credit card, debit card or even direct funds transfer to the bank account. Another advantageous feature about payment gateways is that it keeps track of all receipts and updates the receivables balance in the accounting books. This valuable feature enables accurate recording and effective management of payments.

Live Financial Reporting

As soon as an entry is posted into the accounting system, it is reflected in the final reports. This means that business decisions can be made instantly.

Overall, the greatest feature of accounting software is that it saves time and increases productivity. Let’s now discuss how this is achieved.

How Does Accounting Software Improve Productivity?

Due to the fact that accounting software allows increased productivity in the administrative and accounting areas, this means that human efforts to complete the tasks are significantly reduced. Take an example of the calculation of profit and loss on the investment. Human efforts are not needed to produce these figures as the investment module of the accounting software takes care of this. The only requirement is that the values are entered into the software at the time of the closing of the accounting period.

There are numerous calculations that the system automatically performs, thereby reducing human efforts. These calculations include, depreciation, interest expense, amortization, provision for inventory, provision for bad debts, impairment, tax liability (subject to adjustments) and many more. In order to get the most value out of the accounting software, due care needs to be taken to ensure that the right software for the business is selected.

Following will be a discussion on the factors that should be considered when choosing an accounting software for the business.

Factors to Consider When Choosing Accounting Software

Firstly, there is a strong necessity to assess your needs when choosing accounting software. As choosing an accounting software means that a large commitment must be taken, it is crucial to understand how to assess whether you need the software for you business.

Once you have committed and made up your mind to implement accounting software, some consideration of additional factors must be made before choosing, which will now be discussed.

Industry of Your Business

Accounting software can be specialised and tailored to assist businesses in different industries. For example, accounting software developed for the construction industry allows the management and tracking of expense distribution for different properties. It also gives the option to track budget, change order, and final costs incurred in the construction.

Level of Integration Required

If the processes of your business are complex and sophisticated, then a more advanced level of integration is required to facilitate the accounting software.

Desktop or Cloud Based

You will be able to opt for a desktop or cloud based accounting software. The superior option is the cloud based system as data is stored in a remote server of the company providing the services. This enables the access of data in just a few clicks from your computer. On the other hand, with desktop based software, the data remains on the hard drive of your computer. This will inevitably lead to problems as you run the risk of having difficulty retrieving data if there is a problem with the computer.

Level of Automation

If you desire to reach a higher level of automation in the accounting processes of your business, there will be a need to implement this advanced automation and vice versa.

Business Scalability

If your business is in the position where it is expected to grow in the short term, then it is advisable to implement advanced accounting software. Usually, large corporations use accounting software that provides a high level of integration and automation.

Do Small Businesses Need Accounting Software?

The answer to this question is generally going to be a “yes” because of the following facts:

The cost of implementing software is lower than the benefits that it can achieve. Even though there is a need to consider if your business will succeed with the software, you can still benefit from software even if your business only has a few transactions a week. This is because there is a possibility that your business would grow and the benefit will be that you will already be trained to use the software.

The software will enable the business managers to make useful and strategic business decisions. You will be able to generate insightful and strategic financial reports with just a few clicks. This ease of report generation can help your business grow.

Usually, small business are profitable, however, they face a common situation of liquidity problems. With accounting software, you will be able to track expenses and locate where funds have been used. This places the business decision makers in a position where they can control the cash flow efficiently.

What Accounting Software do Large Corporations Use?

Large corporations are known to use ERP that allows them to have higher integration and advanced automation. All the functions and modules of the software are interlinked to the extent that overall accounting and administrative functions are able to be done with speed. ERP can be customized depending on the needs of the business. Specialized modules can also be added if you have accounting related to some specialized area, which in turn leads to higher efficiency of the entire system.

Conclusion

Accounting software are used by businesses throughout the world. Its main aim and consequence is that the overall efficiency of the business processes are enhanced. Normally, the accounting software are divided into different modules which are linked with each other, while allowing automation of the overall processes for administration and accounting.

Accounting software can broadly reach all facets of the business processes. For example, it comes with the ability to create invoices, manage payables, manage receivables, banking, customer management, treasury management, asset management, vendor management, and so much more. It should also be mentioned that the functions and features of the accounting software are dependent on the level of the subscription. So if there is a need to have an advanced subscription, you will be rewarded with higher integration and automation.

Frequently Asked Questions

What is SaaS in accounting?

SaaS stands for software as a service. This kind of software is a service model whereby the customer is charged for every period that they use the service subscription. All the data can be accessed via the internet since the application is hosted on a remote server of the service provider. This means that the customer does not need to install the software in their hard drive.

Can software replace accountants in the future?

The answer to this question is “yes”. Although software can replace accountants in the future, there are some human elements that cannot be eliminated completely. Repetitive tests such as the input of journal entries and other tasks can be automated and an accountant may not be needed. However, there are subjective areas where human skills are always needed.

How much does accounting software cost?

Depending on the subscription level that the business has with the service provider, it can cost anywhere from NZ$15 upwards to NZ$150,000+ per month. The cost will also depend on how advanced a system that the business would prefer.

What is an integrated accounting system?

An integrated accounting system is a software where accounting and operational modules of the software are interlinked with each other. Since, the output of one module is used as input for the next, the overall efficiency of the accounting functions and business processes is greatly increased.

What is cloud-based accounting software?

Cloud-based accounting software means that your accounting data is stored on a remote server. In order to access the data that you require, there will be a need to reach the remote server via internet protocol. It is also important to note that the company providing the accounting software services is responsible for server maintenance and security.

Looking for simple accounting and invoicing software for New Zealand small business? Try it free:

- Free invoice software

- Recurring invoice software

- Quoting & Invoicing Software

- Online invoice software

- Small business invoice software

- Auto repair shop invoice software

- Plumbing invoice software

- Pest control invoice software

- HVAC invoice software

- Contractor invoice software

- Lawn care invoice software

- Construction invoice software

- Catering invoice software

- Electrician invoice software

- Trucking invoice software

- Field service invoice software

- Service invoice software

- Medical invoice software

- Handyman invoice software

- Consulting invoice software

- Pool service invoice software

- Locksmith invoice software

- Childcare invoice software

- Paintless dent repair invoice software

- Jewellery invoice software

- Tire shop invoice software

- Rental invoice software

- Travel agency invoice software

- Nursery invoice software

- Interior design invoice software

- Computer repair invoice software

- Hotel invoice software

- Daycare invoice software

- Towing invoice software

- B2b invoice software

- Photography invoice software

- Wheel repair invoice software

- Dental lab invoice software

- Courier invoice software

- Publisher invoice software

- Restaurant invoice software

- Logistics invoice software

- Property management invoice software

- Real estate invoice software

- Snow removal invoice software

- Timber invoice software

- Hosting invoice software

- Hourly dump trucking invoice software

- Cleaning service invoice software

- Truck repair shop invoice software

- Car sales invoice software

- Architecture invoice software

- Carpet cleaning invoice software

- It invoice software

- Window cleaning invoice software

- Waste collection service invoice software

- Appliance repair invoice software

- Home care invoice software

- Recruitment agency invoice software

- Rink invoice software

- Door service invoice software

- Gym invoice software

- Furniture repair service invoice software

- Equipment rental invoice software

- Maid service invoice software

- Junk removal invoice software

- Chimney service invoice software

- Digital agency invoice software

- International invoice software

- Invoice management software

- Invoice and inventory software

- Cloud invoice software

- Invoice software for sole traders

- Proforma invoice software

- Freelance invoice software

- Customizable invoice software

- Proposal and invoice software

- Invoice software for tradesmen

- Invoice software with payment reminders

- Invoice Software for Making PDF Invoices

- Monthly invoicing software

- Invoice and customer database software

- Estimating and invoicing software

- Free quoting software

- Free online invoice software

- Free small business invoice software

- Free auto repair shop invoice software

- Free plumbing invoice software

- Free pest control invoice software

- Free HVAC invoice software

- Free contractor invoice software

- Free lawn care invoice software

- Free construction invoice software

- Free catering invoice software

- Free electrician invoice software

- Free trucking invoice software

- Free field service invoice software

- Free service invoice software

- Free medical invoice software

- Free handyman invoice software

- Free consulting invoice software

- Free pool service invoice software

- Free locksmith invoice software

- Free childcare invoice software

- Free paintless dent repair invoice software

- Free jewellery invoice software

- Free tire shop invoice software

- Free rental invoice software

- Free travel agency invoice software

- Free nursery invoice software

- Free interior design invoice software

- Free computer repair invoice software

- Free hotel invoice software

- Free daycare invoice software

- Free towing invoice software

- Free B2B invoice software

- Free photography invoice software

- Free wheel repair invoice software

- Free dental lab invoice software

- Free courier invoice software

- Free publisher invoice software

- Free restaurant invoice software

- Free logistics invoice software

- Free property management invoice software

- Free real estate invoice software

- Free snow removal invoice software

- Free timber invoice software

- Free hosting invoice software

- Free hourly dump trucking invoice software

- Free cleaning service invoice software

- Free truck repair shop invoice software

- Free car sales invoice software

- Free architecture invoice software

- Free carpet cleaning invoice software

- Free IT invoice software

- Free window cleaning invoice software

- Free waste collection service invoice software

- Free appliance repair invoice software

- Free home care invoice software

- Free recruitment agency invoice software

- Free rink invoice software

- Free door service invoice software

- Free gym invoice software

- Free furniture repair service invoice software

- Free equipment rental invoice software

- Free maid service invoice software

- Free junk removal invoice software

- Free chimney service invoice software

- Free digital agency invoice software

- Free international invoice software

- Free invoice management software

- Free invoice and inventory software

- Free cloud invoice software

- Free invoice software for Sole traders

- Free proforma invoice software

- Free freelance invoice software

- Free customizable invoice software

- Free proposal and invoice software

- Free invoice software for tradesmen

- Free invoice software with payment reminders

- Free invoice and customer database software

- Free accounting and invoicing software

- Free estimating and invoicing software

Good to Know: