Invoice Date in New Zealand

Invoice Date is a Significant Component of the Invoice

The invoice date is significant as it represents the date of billing. That is, when the customer is billed to pay for the order for which they have placed. This date usually happens after the product is delivered or after the service has been performed. However, often, the invoice date can be before this and is then known as an advance invoice.

The invoice date is a significant component of the invoice due to the following attributes:

Helps to locate the nature of the accounting transaction

The date of the delivery of goods can be seen by the goods delivery note. If the date of the invoice is before the date of the goods delivered, then this becomes an advance invoice as the business has requested an advance from the customer.

Since the business needs to fulfil the commitment to recognize revenue, the cash received via such invoice is recorded as a liability because this receipt is an obligation for the business to perform certain tasks. As soon as the commitment is fulfilled, the advance is removed and revenue is then recorded in the books.

If the date of the invoice is after the goods have been delivered, this means that the business has already fulfilled its commitment and so they have all the rights to record revenue or income in the books.

These features highlight that there is a significant change in accounting with any change in the invoice date, and this shows that the invoice date is an important piece of accounting information.

Helps to track remaining days in due date for payment

Generally, credit is approved for 7/15/30 days and the date of the invoice acts as day one. The calculation of the due date can be achieved by this invoice date. For example, if the credit is approved for 30 days and the invoice date is December 1, then at December 15, the payables manager can easily see that the business has 15 days to pay that certain invoice.

Crucial element of accounts receivable aging

Another significance of the invoice date is that the calculation for accounts receiving aging starts with the invoice date. There are two main steps for the calculation of receivable aging. The first step involves comparing the invoice date with the current date. This will enable the business to see how many days have lapsed since the invoice was issued. In the second step, these days are spread into respective categories or days slots. This can have enormous consequences because if the invoice date is not correct or reliable, this can lead to a massive impairment of the overall aging and also may bring about skewed decisions or analysis based on this calculation.

The official date of updating the accounting record

An invoice is a source document that is referred to and stored. It is used to update the accounting records and the invoice date of these documents is considered the official date of when transactions need to be posted into the accounting system. If the accounting date is incorrect, this will lead to a higher chance of impairment in the accounting records.

Helps to determine the cut-off for the accounting period

Cut-off date means that the revenue and expense for period 1 must be recognized in period 1. As an example, if the sale is made on January 1, it must be recorded in the new year and not the previous one.

The invoice date on the invoice as well as the date of the goods delivery note are considered an essential source to assess the accuracy of the cut-off. In practice, at the end of the year audits, the auditors usually check the dates of the last three invoices at the year end and also the opening three invoices of the new accounting year. This helps for them to see if there has been correct recording in the correct accounting period.

Further, the invoice date is crucial for auditors to ascertain the periodic profit or loss. If the sales invoices are not recorded in the correct accounting periods, there is a greater potential of error as it may understate or overstate periodic revenue and therefore profit or loss at the end of the period.

Tax professionals need to calculate tax liability

The invoice date is used post-transaction in the accounting system. It can be understood that if the invoice date is not correct, the date of the posting of the transaction may not be correct. This leads to the incorrect recording of the transaction in a wrong accounting period. The consequence of this is that it will impact on the profit or loss and also the subsequent calculation of tax. This is because the periodic profit or loss are the first figures that are considered in the calculation of tax liability or expense.

All of the above points shows that the invoice date is an important component of the invoice and is essential for the recording of accounting and other operational aspects of the business. Next will be a discussion on how to handle the situation when the invoice date is not correct.

How do we Deal With an Incorrect Invoice Date?

The corrective action that should be taken when an incorrect invoice date is recorded, will depend on the different perspective from the seller or buyer.

From the seller's perspective

Since an incorrect date on the sales invoice can impact the reported revenue or profit, one way to fix this is to change the date of the invoice by inputting the correct date in the accounting system. This can be done effectively as most accounting systems allow this correction. In the situation where this is not possible, a credit note can be issued to write off the invoice with the incorrect date and a new invoice with the correct date can be generated and issued.

If however, the accounting period has been closed and an invoice had the incorrect date posted, there will be the need to adjust the transaction via the retained earnings/opening equity.

From the buyer’s perspective

An incorrect date on expenses will impact the overall expenses and business profit. To correct this, an invoice with the correct date should be requested from the seller with a corresponding update in the accounting record. Another way to deal with this situation is to issue a debit note, remove the invoice which had the incorrect date and then post a new invoice with the correct date.

If the accounting period has closed with the incorrect invoice date, there will be a need to post an adjustment in opening retained earnings.

Next we will explore some further accounting rules related to the invoice date.

Invoice Date Rules (Accounting Rules for Invoice Date)

The accounting rules for the invoice date are different for accrual and cash basis of accounting. In the accrual method, the invoice date helps to determine the period of posting for the accounting transaction. In this way, the invoice date is crucial. Take the example of a sales invoice that was issued on the 31 December. The accounting rule here is to record the sales transaction in December. This adheres to the matching concept of accounting which states that revenue should be recognized and recorded in the period in which it was earned. If this transaction is recorded in the next month of January, this will not be accurate as it will impair the matching concept of accounting.

This is different to the cash basis of accounting where revenue is recorded when the customer pays the bill. In this situation the invoice date which is written on the invoice is not relevant in terms of updating the accounting record.

Invoice Date vs. Other Important Dates Comparison

Of particular importance, is that the date of the invoice should not be confused with other dates. These different concepts will now be discussed:

Invoice Date vs. Delivery Date

As noted above, the invoice date is when the customer is billed to pay for the invoice. This is contrasted to the delivery date, which is when the goods are dispatched or handed over to the customer. If the customer is billed on the day of delivery, then the invoice date and delivery date will be the same. It will depend to the terms of trade to see if the two dates will fall on the same day.

There are some circumstances where the customer is billed before the dispatch of goods. This will mean that the invoice date will be before the delivery date and this results in an advance invoice. On the flip side, a customer may be billed on a day after the goods were dispatched. In this situation, the invoice date is after the delivery date.

Invoice Date vs. Billing Date

The invoice date and billing date are generally the same. In fact, the invoice date is when the customer is billed for products delivered or services that have been performed. These two dates can be used interchangeably.

Invoice Date vs. Due Date

The difference between these two dates its that the invoice date is the date of billing whereas the due date is when the customer is required to make payment by. The invoice date and due date will be the same if the customer is required to pay on the day of the billing. If the customer has been approved for credit, the due date is moved to the number of days that the credit was approved. To illustrate this, if the invoice date is January 1 and the credit is approved for 30 days, then the due date for payment moves to January 31st.

Invoice Date vs. Posting Date

The invoice date is the day of billing and the posted date is when the invoice is posted into the accounting system. The invoice date and posting date should be the same.

Also, of importance, is that the concept is different for cash based accounting. In cash based accounting, the invoice is posted when the cash has been received, or paid and the invoice date is of little importance.

Invoice Date vs. Payment Date

The payment date is different to the invoice date. As mentioned previously, the invoice date is when the customer is billed for the goods delivered or service performed. The payment date is when the customer actually pays for the invoice. However, these two dates will be the same if the customer pays on the same date as the billing. Here, the invoice date and payment date will be the same. In the situation of a credit customer, the payment date moves forward when the payment is actually made.

Invoice Date vs Accounting Date

The accounting date is when the invoice is accounted for in the accounting system. To illustrate, if the company follows a cash basis accounting system, the accounting date is when the payment is received from the customer, because the ledger is updated on this day. Here, it does not matter what date was entered on the invoice.

The accounting date can also be the same as the invoice date. Say, for example, if the company uses an accrual accounting system and an invoice is issued using the accounting software, it is posted to the ledger on the same day. This makes the invoice date and accounting date, stand the same.

Invoice Date vs. Purchase Order Date

The purchase order date is the date when the buyer sends an order requirement for goods, to the seller. This is different to the invoice date which is when the seller sends the bill for the order or requirements that the customer has received. If the customer is sent an invoice on the same day as the purchase order, then the purchase order date will be the same as the invoice date.

Invoice Date vs. Transaction Date

These two dates can be the same or different depending on the company’s policy and operations. The transaction date is the day when the financial or economic event takes place. This might include when goods are dispatched or when services are performed for the customer. If a company bills a customer on the same day as the delivery of goods, the transaction date and invoice date will be the same.

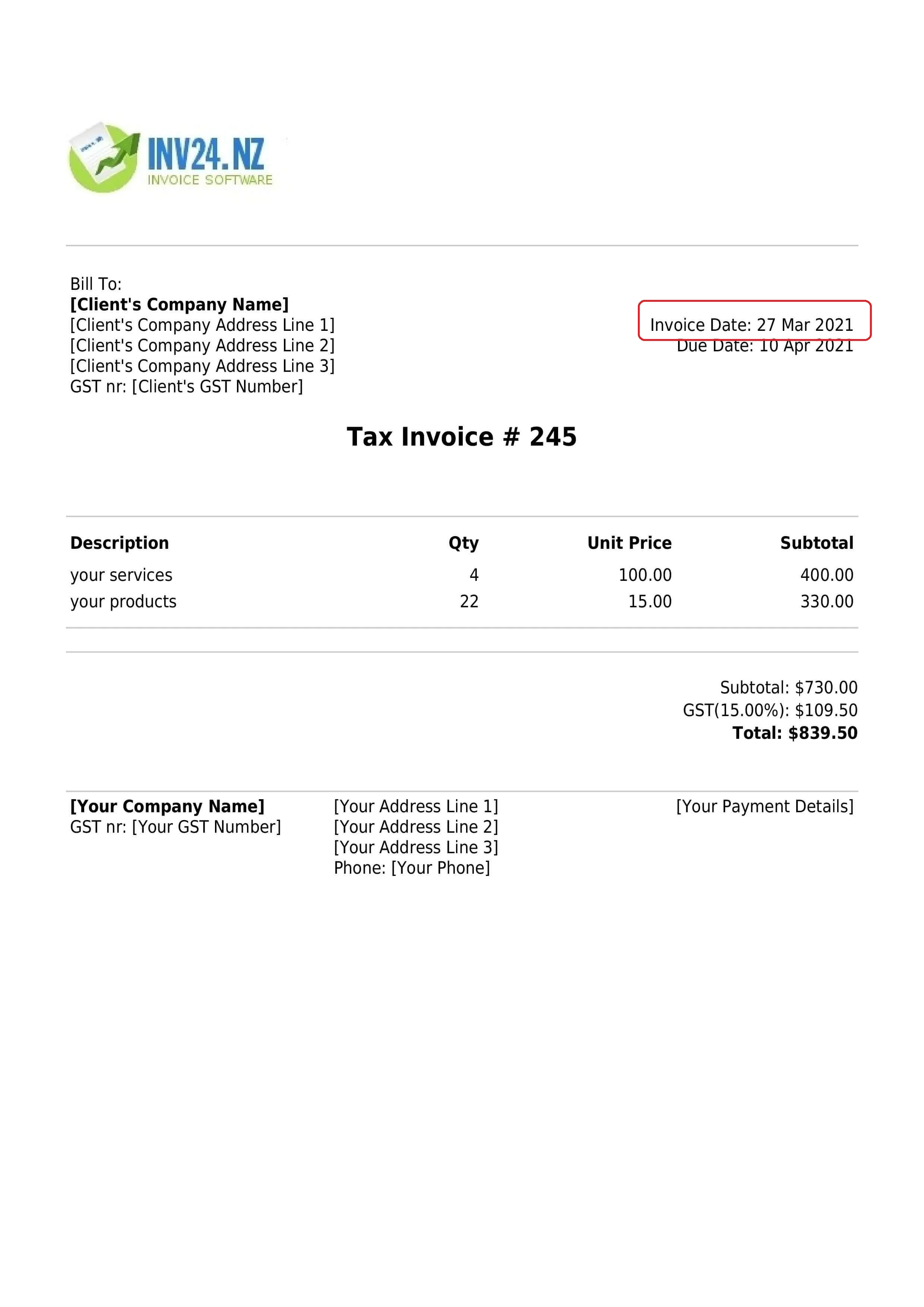

Format of Invoice

Setting the correct format of an invoice date enables the recipient to distinguish whether it is the day or month that comes first, as this is often a point of confusion.

This issue is not too significant if the trade takes place within the country. In this situation the normal format of dates will follow the custom of that country. However, if the business is an import and export business where customers are from across the globe, serious problems due to confusion over formatting can develop. For instance, the United States use the format of MM/DD/YYYY. However, most European countries uses the DD/MM/YYYY format. Due to this inconsistency, there can be significant confusion regarding the payment terms, the due date, delivery date and other terms of trade. In order to bring some clarity and avoid this confusion, the following tips can be effective:

- Send invoices in the format of the customer’s country. If say for instance, you are exporting to Europe. In this scenario, you can use the DD/MM/YYY format. It is good practice to ensure that this changed date format is noted and that the whole team, especially the accountant and bookkeeper, are aware of this format for this particular customer.

- A simple way to erase any ambiguity about the date and month, using the date format where the month is written in words, such as, “1 October, 2023 is helpful.

- Another alternative is to write the date format along with the date. This helps to clearly communicate the format that you have used.

- If the user does not understand the invoice date format, it will create difficulty in calculating aging as the correct date and month will not be ascertained.

What is Accounts Receivable Aging / Invoice Date Aging?

In this section, we will discuss what receivables aging is and how it works.

Invoice date aging is used to categorize unpaid invoices in line with the length of time in which the invoice was not paid. Some examples of typical time brackets include 1-30 days, 31-60 days, 61-90 days and over 90 days.

The date of the invoice is compared with the current date (date of aging preparation). This is used to calculate the number of days that the invoice was not paid and these calculated days are sorted into respective brackets. To illustrate, if the calculated days are 26, then this will fit in to the 1-30 days bracket. If the calculated days are 65, then this will fall into the 61-90 days bracket and so on.

Once all the invoices are sorted into the respective brackets, a sheet will be created that will show a complete picture of the length of time that amounts have not been paid. With this sorted data, the collections department will perform their work effectively as they will be able to follow up on any unpaid invoices and take corrective action.

Conclusion

Since the invoice date is used as a basis for deciding accounting treatment, the invoice date is one of the most crucial and significant components of an invoice. In terms of accounting, it helps to see whether the payment received via the invoice, is to be recorded as income or liability. It also helps to track due dates in the case of credit sales.

The invoice date is the official date for updating the accounting system and also acts as an important constituent of receivable aging. Any error on the invoice date needs to be corrected and this correction needs to be backed by appropriate documentation.

The invoice date is also known as the billing or issuing date. Moreover, it can be the same or different from the transaction date, due date and accounting date.

There is no universal rule for differences in invoice dates and can be the same or different depending on, the relevant scenarios, such as when goods were dispatched, as well as other factors.

If a business uses an accrual system of accounting, the invoice date becomes more relevant and significant.

As mentioned, the invoice date is an essential component of receivable aging. So in this regard, it is important to ensure that no issue will arise due to the formatting, when issuing invoices. This is particularly so in an import and export business.

Frequently Asked Questions

Can the invoice date be changed after an invoice has been issued?

The answer is “yes” the invoice date can be changed after an invoice has been issued. In this scenario, this correction needs to be backed by some reasonable logic. So, if the incorrect invoice date was due to human error, then the invoice date can be corrected. This must still be backed by supporting documents as auditors, tax authorities as well as the government may request or demand to review them.

To prevent any adverse repercussions, it is of the utmost importance that there should never be any intention to manipulate accounting records in any way. Otherwise, there may be financial penalties from financial institutions as well as a dent on the reputation of the business.

What is a future-dated invoice?

A future-dated invoice is when the seller of goods or service provider sends an invoice as a notice and their intention is not to bill on that date but on a future date. These types of invoices are often used in the following situations:

- When an invoice is backed by contractual terms

- There is a pre-agreed schedule of payments

- The business is a subscription-based business and the next billing cycle is to be started at a future date

Is it possible to backdate an invoice?

Yes, it is possible to backdate an invoice. This correction needs to have relevant back up and a proper reason is needed to backdate an invoice. Some examples of when an invoice can be backdated include, error, a change in the agreement, or business terms. This underlying reason for the change must not be to manipulate accounting records or adversely impact any regulatory compliance.

Is the invoice date the same as the purchase date?

The purchase date is when a buyer acquires ownership of goods and represents the date on which the customer has acquired risks and rewards related to goods. On the other hand, the invoice date is when a customer is billed. These two dates can be different, and the same as well, such as when the customer is billed on the same date of purchase. In that situation, the invoice date and purchase date stand the same.

Is the invoice date the issue date?

The answer is “yes”, the invoice date and issue date are the same and can be used in place of another. As explained, the invoice date is when it is issued to request payment from the customer.

Is the invoice date more significant in the case of an accrual accounting system?

Yes, the invoice date becomes more important in the case of an accrual based accounting system. This is because this date is the official date to update the accounting record. However, in cash basis of accounting, the date of receiving payments acts as the official date of updating the accounting record. This means that the invoice date is of more significance in the case of an accrual based accounting system.

Invoicing tools for New Zealand: